Laugardagur, 25. apríl 2009

Fjölmiðlarnir unnu Alþingiskosningar á Íslandi: sigur RÚV

Þá er kosningabaráttu fjölmiðlafólks Íslands lokið. Lýðræðið tapaði.

Rúmlega 71% kjósenda kusu ekki ESB-Samfylkinguna

- eina flokkinn sem hafði ESB sem aðalmál á stefnuskrá sinni. Greinilegt er að þjóðin vill ekki ganga í ESB

Sjálfstæðisflokknum refsað hrikalega fyrir svik við sjálfstæðisstefnuna

Sjálfstæðisflokkurinn lét Samfylkinguna teyma sig burt frá sjálfstæðisstefnunni á asnaeyrunum. Hin nýja forusta flokksins verður að taka til og endurbyggja strekan flokk á upphaflegum grunni sjálfstæðisstefnunnar. Ég treysti því

Samfylkingin og Sjálfstæðisflokkurinn settu fullveldi Íslands í hættu með því að stoppa ekki skuldsetnignu banka og fjármálageirans

Eftirlit með fjármála- og bankakerfi Íslands brást algerlega í höndum Samfylkingarinnar.

Samfylkingin brást algerlega sem samstarfsaðili í ríkisstjórn á örlagastundu. Leynd dagskrá flokksins hefur hrúgað miklum skuldum á þegna Íslands - miklum skuldum. Samfylkingin er núna skuldugasti stjórnmálaflokkur í sögu Íslands. ESB þráhyggja Samfylkingarinnar hefur kostað íslenksa skattgreiðendur offjár og sóað dýrmætum tíma í miðju björgunarstarfi í ekki neitt - með stuðningi Framsókarnflokksins

Vinstri Grænir eru sigurvegarar

Það eru Vinstri Grænir sem standa sem sigurvegarar. Ég óska þeim til hamingju með sigurinn. Vinsamlegast farið vel með valdið og takið það alvarlega. Afstýrið að Ísland verði selt. Afstýrið nýútrásar landsöluáformum Samfylkingarinnar

Krónan mun bjarga efnahag Íslands, - ekki ríkisstjórn

Gjaldmiðill Íslands mun bjarga efnahag þjóðarinnar með sínum stóra sveigjanleika. Hann mun tryggja líf og samkeppnisaðstöðu útflutnings- og verðmætasköpunar og halda skipinu gangandi. Krónan vinnur nú dag og nótt við að afrugla hagkerfi Íslands eftir hræðilega misnotkun. Þetta VERÐA menn að skilja. Enginn gjaldmiðill þolir svona meðferð án áfalla. Óhóflega skuldsettum fyrirtækjum verður refsað hræðilega fyrir lélega stjórnum og stefnumörkun. Þau munu fara á hausinn eins og bankarnir því þau þola ekki mótbyr. Eftir mun standa skógur með sterkum trjám sem þola storm. Svo mun vaxa nýr og heilbrigður skógur, sem gefur arð

Það er kreppa um víða veröld

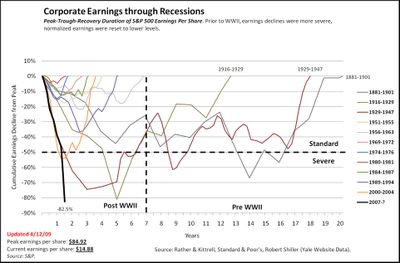

Hagnaður fyrirtækja mun almennt bíða afhroð um allan heim. Þó munu þau fyrirtæki sem lærðu vel og vandlega í fyrri kreppum standast raunina. Þau eiga oft sand af peningum til að verjast dauða og skulda ekki einn einasta aur í mörgum tilfellum. Þau geta því tekið þátt í næstu uppsveiflu og malað gull. Dæmi: mörg tæknifyrirtæki sem lærðu mikið í dot.com hruninu. Myndin sýnir hagnað fyrirtækja í hinum ýmsu kreppum. Þykka línan sem teigir sig niður þarna lengst til vinstri á myndinni, sýnir hrun hagnaðar fyrirtækja í S&P vísitölu BNA núna, - miðað við fyrri stórar kreppur. Búið ykkur undir það sama

Fyrri færsla:

Ég skora á alla sjálfstæðismenn Íslands að kjósa

Tegnt efni:

Jón Baldur Lorange

Frost kyrrstöðunnar færist yfir þjóðfélagið

ESB-frétt dagsins

Spánn: atvinnuleysi mælist nú 17,4%

Flokkur: Stjórnmál og samfélag | Breytt 26.4.2009 kl. 08:54 | Facebook

Nýjustu færslur

- Eitthvað sem ekki passar hér [u]

- Kristrún stígur ekki í vitið, svo mikið er nú víst

- Þorgerður mín

- Kína komið til "ósubbulegs" sálfræðings

- ESB og Kína þekkja ekki bandaríska miðvestrið

- Bóndinn og prófessorinn í Selma um tolla Trumps. Grænland

- Evrópa er á leiðinni á nauðungaruppboð: Kaninn unir ekki að G...

- Svo lengi sem Grænland er viðriðið Danmörku mun heimurinn ekk...

- Landsölupakkhús Þorgerðar fúlt út í JD Vance

- Kannski hægt að byrja á farsímavef Veðurstofunnar - strax í d...

- Hamast við moksturinn í Reykjavík

- Grunnvextir hækka á evrusvæðinu - varanlega

- Fallbyssur Trumps í tollamálum

- Bandaríkin eru tilbúin að fjárfesta milljörðum dala í Grænlan...

- Já, Pólverjar verða að vakta landamærin upp að Þýskalandi. Þa...

Bloggvinir

-

Heimssýn

Heimssýn

-

Samtök Fullveldissinna

Samtök Fullveldissinna

-

ÞJÓÐARHEIÐUR - SAMTÖK GEGN ICESAVE

ÞJÓÐARHEIÐUR - SAMTÖK GEGN ICESAVE

-

Guðmundur Jónas Kristjánsson

Guðmundur Jónas Kristjánsson

-

Ragnhildur Kolka

Ragnhildur Kolka

-

Hannes Hólmsteinn Gissurarson

Hannes Hólmsteinn Gissurarson

-

Haraldur Hansson

Haraldur Hansson

-

Haraldur Baldursson

Haraldur Baldursson

-

Páll Vilhjálmsson

Páll Vilhjálmsson

-

Halldór Jónsson

Halldór Jónsson

-

Valan

Valan

-

Samstaða þjóðar

Samstaða þjóðar

-

Frjálshyggjufélagið

Frjálshyggjufélagið

-

Sigríður Laufey Einarsdóttir

Sigríður Laufey Einarsdóttir

-

Eyþór Laxdal Arnalds

Eyþór Laxdal Arnalds

-

Jón Valur Jensson

Jón Valur Jensson

-

Samtök um rannsóknir á ESB ...

Samtök um rannsóknir á ESB ...

-

Kolbrún Stefánsdóttir

Kolbrún Stefánsdóttir

-

Vilhjálmur Örn Vilhjálmsson

Vilhjálmur Örn Vilhjálmsson

-

Jón Baldur Lorange

Jón Baldur Lorange

-

Guðjón E. Hreinberg

Guðjón E. Hreinberg

-

Jón Ríkharðsson

Jón Ríkharðsson

-

Anna Björg Hjartardóttir

Anna Björg Hjartardóttir

-

Loftur Altice Þorsteinsson

Loftur Altice Þorsteinsson

-

Valdimar Samúelsson

Valdimar Samúelsson

-

Fannar frá Rifi

Fannar frá Rifi

-

Bjarni Jónsson

Bjarni Jónsson

-

Sigurður Þorsteinsson

Sigurður Þorsteinsson

-

Gunnar Ásgeir Gunnarsson

Gunnar Ásgeir Gunnarsson

-

Haraldur Haraldsson

Haraldur Haraldsson

-

Örvar Már Marteinsson

Örvar Már Marteinsson

-

Kristin stjórnmálasamtök

Kristin stjórnmálasamtök

-

Gestur Guðjónsson

Gestur Guðjónsson

-

Ingvar Valgeirsson

Ingvar Valgeirsson

-

Predikarinn - Cacoethes scribendi

Predikarinn - Cacoethes scribendi

-

Guðsteinn Haukur Barkarson

Guðsteinn Haukur Barkarson

-

Guðmundur Helgi Þorsteinsson

Guðmundur Helgi Þorsteinsson

-

Lísa Björk Ingólfsdóttir

Lísa Björk Ingólfsdóttir

-

Bjarni Kjartansson

Bjarni Kjartansson

-

Bjarni Harðarson

Bjarni Harðarson

-

Guðrún Sæmundsdóttir

Guðrún Sæmundsdóttir

-

Sveinn Atli Gunnarsson

Sveinn Atli Gunnarsson

-

gudni.is

gudni.is

-

Gústaf Adolf Skúlason

Gústaf Adolf Skúlason

-

Tryggvi Hjaltason

Tryggvi Hjaltason

-

ESB

ESB

-

Marinó G. Njálsson

Marinó G. Njálsson

-

Baldvin Jónsson

Baldvin Jónsson

-

Elle_

Elle_

-

Sigurbjörn Svavarsson

Sigurbjörn Svavarsson

-

Emil Örn Kristjánsson

Emil Örn Kristjánsson

-

Johnny Bravo

Johnny Bravo

-

Jón Finnbogason

Jón Finnbogason

-

Rýnir

Rýnir

-

Þórarinn Baldursson

Þórarinn Baldursson

-

P.Valdimar Guðjónsson

P.Valdimar Guðjónsson

-

Már Wolfgang Mixa

Már Wolfgang Mixa

-

Ívar Pálsson

Ívar Pálsson

-

Júlíus Björnsson

Júlíus Björnsson

-

Guðjón Baldursson

Guðjón Baldursson

-

Baldur Fjölnisson

Baldur Fjölnisson

-

Ingibjörg Álfrós Björnsdóttir

Ingibjörg Álfrós Björnsdóttir

-

Einar Ólafsson

Einar Ólafsson

-

Sigríður Jósefsdóttir

Sigríður Jósefsdóttir

-

Vilhjálmur Árnason

Vilhjálmur Árnason

-

gummih

gummih

-

Sveinn Tryggvason

Sveinn Tryggvason

-

Helga Kristjánsdóttir

Helga Kristjánsdóttir

-

Jóhann Elíasson

Jóhann Elíasson

-

Baldur Hermannsson

Baldur Hermannsson

-

Kristinn D Gissurarson

Kristinn D Gissurarson

-

Magnús Jónsson

Magnús Jónsson

-

Ketill Sigurjónsson

Ketill Sigurjónsson

-

Birgitta Jónsdóttir

Birgitta Jónsdóttir

-

Axel Jóhann Axelsson

Axel Jóhann Axelsson

-

Þorsteinn Helgi Steinarsson

Þorsteinn Helgi Steinarsson

-

Aðalsteinn Bjarnason

Aðalsteinn Bjarnason

-

Magnús Þór Hafsteinsson

Magnús Þór Hafsteinsson

-

Erla Margrét Gunnarsdóttir

Erla Margrét Gunnarsdóttir

-

Sigurður Sigurðsson

Sigurður Sigurðsson

-

Þorsteinn H. Gunnarsson

Þorsteinn H. Gunnarsson

-

Haraldur Pálsson

Haraldur Pálsson

-

Sveinbjörn Kristinn Þorkelsson

Sveinbjörn Kristinn Þorkelsson

-

Bjarni Benedikt Gunnarsson

Bjarni Benedikt Gunnarsson

-

Jakobína Ingunn Ólafsdóttir

Jakobína Ingunn Ólafsdóttir

-

Ægir Óskar Hallgrímsson

Ægir Óskar Hallgrímsson

-

Helgi Kr. Sigmundsson

Helgi Kr. Sigmundsson

-

Óskar Sigurðsson

Óskar Sigurðsson

-

Tómas Ibsen Halldórsson

Tómas Ibsen Halldórsson

-

Axel Þór Kolbeinsson

Axel Þór Kolbeinsson

-

Kjartan Pétur Sigurðsson

Kjartan Pétur Sigurðsson

-

Hörður Valdimarsson

Hörður Valdimarsson

-

Adda Þorbjörg Sigurjónsdóttir

Adda Þorbjörg Sigurjónsdóttir

-

Þorsteinn Valur Baldvinsson

Þorsteinn Valur Baldvinsson

-

Margrét Elín Arnarsdóttir

Margrét Elín Arnarsdóttir

-

Ásta Hafberg S.

Ásta Hafberg S.

-

Erla J. Steingrímsdóttir

Erla J. Steingrímsdóttir

-

Helena Leifsdóttir

Helena Leifsdóttir

-

Agný

Agný

-

Brosveitan - Pétur Reynisson

Brosveitan - Pétur Reynisson

-

Jón Árni Bragason

Jón Árni Bragason

-

Jón Lárusson

Jón Lárusson

-

Högni Snær Hauksson

Högni Snær Hauksson

-

Kristján P. Gudmundsson

Kristján P. Gudmundsson

-

Kristinn Snævar Jónsson

Kristinn Snævar Jónsson

-

Sigurður Ingólfsson

Sigurður Ingólfsson

-

Rakel Sigurgeirsdóttir

Rakel Sigurgeirsdóttir

-

Sigurður Þórðarson

Sigurður Þórðarson

-

S. Einar Sigurðsson

S. Einar Sigurðsson

-

Pétur Steinn Sigurðsson

Pétur Steinn Sigurðsson

-

Vaktin

Vaktin

-

Sigurjón Sveinsson

Sigurjón Sveinsson

-

Dóra litla

Dóra litla

-

Arnar Guðmundsson

Arnar Guðmundsson

-

Jörundur Þórðarson

Jörundur Þórðarson

-

Rafn Gíslason

Rafn Gíslason

-

Hjalti Sigurðarson

Hjalti Sigurðarson

-

Kalikles

Kalikles

-

Vésteinn Valgarðsson

Vésteinn Valgarðsson

-

Bjarni Kristjánsson

Bjarni Kristjánsson

-

Egill Helgi Lárusson

Egill Helgi Lárusson

-

Gunnar Skúli Ármannsson

Gunnar Skúli Ármannsson

-

Halldóra Hjaltadóttir

Halldóra Hjaltadóttir

-

Jón Pétur Líndal

Jón Pétur Líndal

-

Guðmundur Ásgeirsson

Guðmundur Ásgeirsson

-

Reputo

Reputo

-

Gunnar Helgi Eysteinsson

Gunnar Helgi Eysteinsson

-

Sigurður Sigurðsson

Sigurður Sigurðsson

-

Ólafur Als

Ólafur Als

-

Friðrik Már

Friðrik Már

-

Gísli Sigurðsson

Gísli Sigurðsson

-

Sigurður Einarsson

Sigurður Einarsson

-

Rauða Ljónið

Rauða Ljónið

-

Sumarliði Einar Daðason

Sumarliði Einar Daðason

-

Gísli Kristbjörn Björnsson

Gísli Kristbjörn Björnsson

-

Kári Harðarson

Kári Harðarson

-

Sigurður Antonsson

Sigurður Antonsson

-

Valdimar H Jóhannesson

Valdimar H Jóhannesson

-

Rósa Aðalsteinsdóttir

Rósa Aðalsteinsdóttir

-

Dagný

Dagný

-

Guðmundur Pálsson

Guðmundur Pálsson

-

Jakob Þór Haraldsson

Jakob Þór Haraldsson

-

Birgir Viðar Halldórsson

Birgir Viðar Halldórsson

-

Magnús Ragnar (Maggi Raggi).

Magnús Ragnar (Maggi Raggi).

-

Tíkin

Tíkin

-

Jón Þórhallsson

Jón Þórhallsson

-

Íslenska þjóðfylkingin

Íslenska þjóðfylkingin

-

Erla Magna Alexandersdóttir

Erla Magna Alexandersdóttir

-

Óskar Kristinsson

Óskar Kristinsson

-

Dominus Sanctus.

Dominus Sanctus.

-

Ingólfur Sigurðsson

Ingólfur Sigurðsson

-

Jón Þórhallsson

Jón Þórhallsson

Tenglar

Hraðleiðir

- www.tilveraniesb.net www.tilveraniesb.net Vefsetur Gunnars Rögnvaldssonar

- www.mbl.is

- Donald J. Trump: Blogg - tilkynningar og fréttir Donald J. Trump: Blogg - tilkynningar og fréttir

- Bréf frá Jerúsalem - Yoram Hazony Yoram Hazony er einn fremsti stjórnmálaheimspekingur Vesturlanda í dag

- NatCon Þjóðaríhaldsstefnan

- Victor Davis Hanson bóndi og sagnfræðingur Victor Davis Hanson er einn fremsti sagnfræðingur Vesturlanda í klassískri sögu og hernaði

- Bruce Thornton sagnfræðingur Bruce Thornton er sagnfræðingur - klassísk fræði

- Geopolitical Futures - geopólitík Vefsetur George Friedmans sem áður hafi stofnað og stjórnað Stratfor

- Strategika Geopólitík

- TASS

- Atlanta Fed EUR credit & CDS spreads

- N.Y. Fed EUR charts

- St. Louis Fed USD Index Federal Reserve Bank of St. Louis - Trade Weighted U.S. Dollar Index: Major Currencies

- Atvinnuleysi í Evrópusambandinu núna: og frá 1983 Atvinnuleysi í Evrópusambandinu núna: og frá 1983

Þekkir þú ESB?

Greinar

Lestu mig

Lestu mig

• 99,8% af öllum fyrirtækjum í ESB eru lítil, minni og millistór fyrirtæki (SME)

• Þau standa fyrir 81,6% af allri atvinnusköpun í ESB

• Aðeins 8% af þessum fyrirtækjum hafa viðskipti á milli innri landamæra ESB

• Aðeins 12% af aðföngum þeirra eru innflutt og aðeins 5% af þessum fyrirtækjum hafa viðskiptasambönd í öðru ESB-landi

• Heimildir »» EuroChambers og University of LublianaSciCenter - Benchmarking EU

Bækur

Á náttborðunum

-

: EU - Europas fjende (ISBN: 9788788606416)

Evrópusambandið ESB er ein versta ógn sem að Evrópu hefur steðjað. -

: World Order (ISBN: 978-1594206146)

There has never been a true “world order,” Kissinger observes. For most of history, civilizations defined their own concepts of order. -

: Íslenskir kommúnistar (ISBN: ISBN 978-9935-426-19-2)

Almenna bókafélagið gefur út. -

: Velstandens kilder:

Um uppsprettu velmegunar Evrópu - : Paris 1919

- : Reagan

- : Stalin - Diktaturets anatomi

-

: Penge

Ungverjinn segir frá 70 ára kauphallarreynslu sinni -

: Gulag og glemsel

Um sorgleik Rússlands og minnistap vesturlanda - : Benjamín H. J. Eiríksson

- : Opal

- : Blár

Heimsóknir

Flettingar

- Í dag (4.7.): 1

- Sl. sólarhring: 14

- Sl. viku: 123

- Frá upphafi: 1404859

Annað

- Innlit í dag: 1

- Innlit sl. viku: 86

- Gestir í dag: 1

- IP-tölur í dag: 1

Uppfært á 3 mín. fresti.

Skýringar

Eldri færslur

- Júní 2025

- Apríl 2025

- Mars 2025

- Febrúar 2025

- Janúar 2025

- Desember 2024

- Nóvember 2024

- September 2024

- Júní 2024

- Apríl 2024

- Febrúar 2024

- Janúar 2024

- Nóvember 2023

- Október 2023

- September 2023

- Ágúst 2023

- Júní 2023

- Maí 2023

- Apríl 2023

- Mars 2023

- Febrúar 2023

- Janúar 2023

- Nóvember 2022

- Október 2022

- September 2022

- Ágúst 2022

- Júlí 2022

- Júní 2022

- Apríl 2022

- Mars 2022

- Febrúar 2022

- Janúar 2022

- Desember 2021

- Október 2021

- September 2021

- Júlí 2021

- Mars 2021

- Febrúar 2021

- Janúar 2021

- Desember 2020

- Nóvember 2020

- Október 2020

- September 2020

- Ágúst 2020

- Júlí 2020

- Júní 2020

- Maí 2020

- Apríl 2020

- Mars 2020

- Febrúar 2020

- Janúar 2020

- Desember 2019

- Nóvember 2019

- Október 2019

- September 2019

- Ágúst 2019

- Júlí 2019

- Júní 2019

- Maí 2019

- Apríl 2019

- Mars 2019

- Febrúar 2019

- Janúar 2019

- Desember 2018

- Nóvember 2018

- Október 2018

- September 2018

- Ágúst 2018

- Júlí 2018

- Júní 2018

- Maí 2018

- Apríl 2018

- Mars 2018

- Febrúar 2018

- Janúar 2018

- Desember 2017

- Nóvember 2017

- Október 2017

- September 2017

- Ágúst 2017

- Júlí 2017

- Júní 2017

- Maí 2017

- Apríl 2017

- Mars 2017

- Febrúar 2017

- Janúar 2017

- Desember 2016

- Nóvember 2016

- Október 2016

- September 2016

- Ágúst 2016

- Júlí 2016

- Júní 2016

- Maí 2016

- Apríl 2016

- Mars 2016

- Febrúar 2016

- Janúar 2016

- Desember 2015

- Nóvember 2015

- Október 2015

- September 2015

- Ágúst 2015

- Júlí 2015

- Júní 2015

- Maí 2015

- Apríl 2015

- Mars 2015

- Febrúar 2015

- Janúar 2015

- Desember 2014

- Nóvember 2014

- Október 2014

- September 2014

- Ágúst 2014

- Júlí 2014

- Júní 2014

- Maí 2014

- Apríl 2014

- Mars 2014

- Febrúar 2014

- Janúar 2014

- Desember 2013

- Nóvember 2013

- Október 2013

- September 2013

- Ágúst 2013

- Júlí 2013

- Júní 2013

- Maí 2013

- Apríl 2013

- Mars 2013

- Febrúar 2013

- Janúar 2013

- Desember 2012

- Nóvember 2012

- Október 2012

- September 2012

- Ágúst 2012

- Júlí 2012

- Júní 2012

- Maí 2012

- Apríl 2012

- Mars 2012

- Febrúar 2012

- Janúar 2012

- Desember 2011

- Nóvember 2011

- Október 2011

- September 2011

- Ágúst 2011

- Júlí 2011

- Júní 2011

- Maí 2011

- Apríl 2011

- Mars 2011

- Febrúar 2011

- Janúar 2011

- Desember 2010

- Nóvember 2010

- Október 2010

- September 2010

- Ágúst 2010

- Júlí 2010

- Júní 2010

- Maí 2010

- Apríl 2010

- Mars 2010

- Febrúar 2010

- Janúar 2010

- Desember 2009

- Nóvember 2009

- Október 2009

- September 2009

- Ágúst 2009

- Júlí 2009

- Júní 2009

- Maí 2009

- Apríl 2009

- Mars 2009

- Febrúar 2009

- Janúar 2009

- Desember 2008

- Nóvember 2008

- Október 2008

- September 2008

- Ágúst 2008

- Júlí 2008

- Júní 2008

- Maí 2008

Athugasemdir

...þessari orrustu.

Hans Haraldsson (IP-tala skráð) 25.4.2009 kl. 22:42

Sjálfstæðisflokkurinn kennir öllum öðrum en sjálfum sér um ófarir sínar, í stað þess að líta í eigin barm.

Svona rétt eins og alkinn.

hilmar jónsson, 25.4.2009 kl. 22:45

Hilmar Jónson, þjóðin kennir Sjálfstæðisflokknum um allt, rétt eins dópistinn.

Hrun á hrun ofan. Jóhanna verður að láta þýða það sem hún segir. Ég skil hana ekki.

Vilhjálmur Örn Vilhjálmsson, 26.4.2009 kl. 07:27

Rétt Gunnar: „Samfylkingin og Sjálfstæðisflokkurinn settu fullveldi Íslands í hættu með því að stoppa ekki skuldsetningu banka og fjármálageirans.“

Nú fær Samfylkingin nýtt ávísanahefti að launum, á þjóðarreikninginn með hækkuðum yfirdrætti og allt á margföldum dráttarvöxtum. Gæfulegt!

Ívar Pálsson, 26.4.2009 kl. 08:56

Það er engin þörf á að ganga í Evrópusambandið til að leysa peningamál Íslendinga. Lesið þennan pistil og hugsið málið.

An Unique Global Opportunity for Iceland

This two part proposal offers a bold suggestion that you may not only recapture Iceland back from the hands of the world bankers, but also offer something of unique and rare value to the world that could bring a healthy and stable income to the country.

Many people in the outside world salute what the Icelandic people have done since the currency collapse. You, the people on the street, have brought down and changed your government and forced the resignation of your central banker, yet there is more to be done in order to recapture the country. Unless you go the final distance and replace your monetary system, the same system that led to the financial collapse, in the end, nothing will have changed and the global bankers will own your country.

Ironically, the world today is in desperate need of a country, which will establish a sound monetary system, and this is an opportunity that can both save your country (from the creditors), and bring you global investment never before witnessed in Iceland.

In order to change your monetary system a person first needs to understand it and understand what is wrong with it. Very few people comprehend our global monetary system, but there is an easy analogy to clarify it.

There is an island with ten people upon it who exist through using barter trade to meet their basic needs. The builder, trades his skill to the chef, who trades his foods to the fisherman, and so forth. They decide to issue a convenient currency rather than carrying around their wares. They decide on precious and beautiful golden and silver sea shells that are in very limited supply, and valued by everyone on the island. The fact that these shells are in limited supply is important otherwise they would not hold their value. The shells are collected and given freely to each person and now purchases and sales, and trade can be effected easily. Using their shell currency, there would never be inflation and one shell that today, would purchase a 5 kg. Cod fish, would do so fifty years from now. If, through innovation and modernization, production increased in the island economy yet the quantity of shells remained the same, prices would actually decrease and everyone's standard of living would increase as a result. Pensioners would live a wonderful retirement on their saved shells. This is an example of a healthy currency and monetary system. There is no cost for the shells. There is no price inflation, and modernization and innovation will enhance everyone's standard of living.

Contrast this economy with another island of ten people who also wish for a currency to assist in making trade easier. Instead of using sea shells, a banker rows over and says, 'what you need is a real currency, which I have (these pieces of pretty paper)', and proceeds to loan each of the ten people 1,000 ISK at 5% annual interest rate. There, then, exists 10,000 ISK in total circulation for the economy to function, but at the end of the first year, the banker returns and demands his 5% interest payment of 50 ISK from each person. After each has made the payment they are already in financial problems, for each of the ten people began with a 1,000 ISK loan, but after the first interest payment of 50 ISK, each is left with 950 ISK. After the second interest payment, each is left with 900, and so forth, yet the original loan of 1,000 needs to be repaid, and no one has enough money to repay the loan. Perhaps one or two smart islanders realize what is happening and work extra hard to afford the interest payments and still retain the 1,000 ISK, but this means some of their neighbours end up at year end with even less money. Under this system the banker is guaranteed to end up with most of the assets and ownership of the island. This is a simplified version of our false monetary system today.

The only way the banker society can function is for more and more loans to be made to more and more people, yet the interest payments for those loans does not even exist (that money has never been created or printed) so people must compete with each other to get that debt repayment out of the existing money supply. This banker's false money creation guarantees inflation as more and more debt must be added to fuel money in the system; it guarantees scarcity as people must complete to make their payments; and it guarantees bankruptcy for people and businesses. The end is always predictable, the bankers end up with all the assets.

What happened last year in Iceland is that everyone realized and acknowledged the country was bankrupt. Most people blamed greedy bankers but failed to realize the corruption of the entire banking system. I know this because, then the IMF rowed over to your Island and gave you more debt to pay off the original debt. In your hearts you know that more debt to your country can not get rid of the old debt. It is like paying off the Visa Card with the Master Card, and before very long, perhaps in the next generation the global bankers will own your country and all the people too. There is not an easy solution. If Iceland joins the EU, which is controlled by the banking system, all hope for getting your island back will disappear.

Iceland is not alone in this situation. The bankers have through coercion, bribery and even military pressure have converted most countries into their 'false money' system. For example, few people are even aware that in conquered countries like Afghanistan and Iraq that their banking systems have already been converted to new 'central banks' owned by the elite few world bankers, and are now charging Muslim peoples interest even though it is against their political law and religious belief system.

What the world needs now is for a country to kick the bankers out and in the analogy above, to return to the sea shell economy – a sound economy that will have no inflation and be based on fair exchange of labour for goods and services, rather than debt and interest payments to the bankers. Of course you can not use sea shells but you can use gold and silver, which will be accepted by trading partners around the world.

Iceland's Very Unique Business Opportunity

Gold and silver have always been a favoured investment by people with money because gold and silver keep track with inflation. In 1913 when the (privately owned) Federal Reserve System started printing the money supply for the United States (and charging them interest when they could print it themselves for free), the price of gold was $29.50/ounce. As the US dollar has devalued over the years because of inflation, gold prices have risen to $890/ounce. Today, Switzerland, the largest producer of gold bullion has had to treble its production of gold bars to keep up with personal demand. Investors around the world are getting very nervous about all this worthless paper money being printed every day by the truck load.

Yet, for investors there is a disadvantage to owing gold and silver. Neither pays any interest or dividends and so there is a cost to own these metals, called safekeeping fees. People must pay to have it safely stored away. Currently there is no country in the world that is on the 'gold standard' meaning that their paper currency is exchangeable into the metal, and because of that, there is a huge opportunity for Iceland.

If Iceland was to convert to the gold standard, two things would happen, you could do away with the false banker's economy, get rid of your IMF debt, and at the same time, attract investors from around the whole world. Here' why.

If your currency is guaranteed exchangeable into gold and silver, investors can bring their bullion to Iceland and for the first time, have an option to earn an income from the bullion. They could elect to have their bullion in safekeeping or convert it to New ISK and loan the money out and earn a return from the bullion. Let's work through an example and first look at the roles of bankers, depositors and borrowers.

Under the new monetary system, banks and bankers would have very different roles than they do today. They would be the safekeepers of people's savings, for which the banks would charge a fee (they like that part), but now they can only loan out money from direct deposits if the depositors allow them to do that. They can no longer create money out of thin air and employ fractional reserve lending (they won't like that part).

Depositors can have either New ISK currency, or gold and silver bullion on deposit, for which they will pay a fee. The depositor can elect to have all or part of their money loaned out to other Icelandic citizens (a borrower) to receive an income from their deposits. In this case, the borrower would pay nominal interest costs, say 2%/year. This income would be split between the depositor and the banker, as the banker must arrange the loan and collect the payments.

For foreign investors with large positions of bullion, they could earn a return for the first time from their gold and silver. Let's say, a retired business man brings $10 million dollars worth of gold to invest in Iceland's banks. If he does not authorize that this money can be lent out to Icelanders, he pays the bank a safekeeping fee, or to earn money on his gold, he could choose to allow all or part of the money to be lent out at the 2% in our example. Half (or some negotiated portion) goes to the banker and the investor makes 1% or $100,000 a year from his gold that up until this point has only cost him money.

There are literally hundreds of thousands of smart successful business people from all over the world who would come to a country with an honest monetary system, and bring their gold and silver, which could be invested into the people and the infrastructure of that country. It would mean thousands of jobs for Icelanders, and it would allow people access to large amounts of real money at low interest rates. The potential income from such a plan could pay off your remaining IMF and other loans in a fairly short period of time.

It is important to state this is not a suggestion to offer a tax haven or tax shelter situation to hide money, but rather to purely offer a safe country for global investment. Recently, the G-20 summit (controlled by the banker elites) has confirmed a crack down on tax-shelter countries (all those countries except the one's controlled by Britain, that is) – to “get money out of tax avoiding people”.

Tax avoiders certainly sound like bad people, but who are they really? The vast majority of them are hard working smart people of business that have worked all their lives to create wealth and are now trying to protect that wealth for themselves and their children against the greedy bankers. Switzerland, which is one of the countries to soon lose this 'money haven' status, closely monitors that depositor's money comes from honest and legitimate sources. It is estimated they could lose over $1 trillion in deposits because of the G-20 ruling.

If Iceland was to charge a flat .05% (half of one percent) safekeeping fee to all foreign investors, the income just on the investment that could leave Switzerland would equal $5,000,000,000 ($5 billion) per year. You can repay a lot of debts very quickly with such an income and provide very well for all the people of the country with health, medical and social benefits, as well. With money flowing into the country, investment would grow rapidly as well. To protect your heritage you should retain controlling interest and ownership of your country's natural resources (minimum 51% as is done in China). In this way, you keep control of your country and provide future income for all citizens,

This is the opportunity before Iceland today to create a real and debt-free country, and attract global investors who are tired of the false money system that is taking over the world.

There is no pain-free way to convert from the banker economy to the gold standard economy. This suggestion is to use what money you have and to purchase sufficient gold and silver bullion that would equal one year's Gross Domestic Production of Iceland, and give what money is remaining back to the IMF. Then dividend the number of current ISK in circulation into the value of the bullion. All outstanding ISK could then be given a value and retired and a new currency be issued. With the new currency, all paper notes would be convertible into a specific number of grams of gold or silver, and silver could be used for the lower denomination coins. Banks in future would become deposit taking institutions and could only facilitate loans from direct deposits, sharing the loan fee with the depositor of that money. Current bank practices of creating money from thin air and fraction reserve lending should end.

Current loan debt, could be repaid in the future as the economy becomes healthy. Iceland could do the same as a number of Central and South American countries and announce a refusal to repay the debt, and the abandonment of the current monetary system.

This final struggle to 'get Iceland back into the hands of the people' is the challenge before you. The bankers of the world will yell and scream and their paid-for politicians will do the same, because they already believe that they own and control your country. It is the humble belief of this writer that what you have gained already came from the 'people in the street', and it can only be those same people who can take on the world's bankers and win.

Good Luck!

Sigurjón Jónsson, 26.4.2009 kl. 10:25

Það er að sjá að allt ESB fylgið hafi varpað öðrum skoðunum sínum til hliðar og kosið xS. Með 70% á hinni vogarskálinni, ætti að vera ljóst að ESB umsókn verður felld í þjóðaratkvæðagreiðslu. Er þá sigur unninn ? Nei alls ekki. Fari ný ríkisstjórn þrátt fyrir allt í aðildarviðræður, þarf enn að tryggja að þjóðin fái að skjósa um samningin. Þetta er eins og í fótboltanum...fallegar sendingar skila ekki sigrinum...það gera mörkin. Orrustunni um Ísland er ekki lokið.

Haraldur Baldursson, 26.4.2009 kl. 10:42

Æ ósköp er þetta nú furðulegur pistill. Er RÚV búið að heilaþvo fólk??

Haraldur: það þarf ekkert að tryggja að þjóðin fái að kjósa um ESB, það ER tryggt að þjóðin fái að kjósa um slíkt, enda kallar aðild á stjórnarskrárbreytingar.

Einar Karl, 26.4.2009 kl. 11:20

Ég á ekki orð yfir túlkunum frétamann niðurstöðum kosningana. Sigur ESB sinna. Þegar ég sá niðurstöðuna hugsaði ég með mér, 30% esb fylgi.

Gunnar Ásgeir Gunnarsson, 26.4.2009 kl. 15:04

Ertu 5 ára?

Ekki vilji fyrir ESB?

Sigur fjölmiðlanna?

Hvílíkur spuni.

Svona er þetta: (Ath: þú mátt spyrja ef þú skilur ekki eitthvað)

Það er mikill meirihluti á alþingi fyrir ESB aðildarviðræðum strax og upptöku evru.

Punktur.

Þessar lyktir mála koma til (og eru því X-D að þakka)

a) vegna þess að þið Sjálstæðismenn gerðuð uppá bak við stjórn landsmála síðustu 18 ár.

b) létuð sprengja síðustu ríkisstjórn vegna hollustu við gamlan foringja í stað þess að bregðast við út frá þjóðarhagsmunum. Big mistake.

c) klúðruðu einkavæðingu bankanna með kunningja kaptítalisma sem olli síðan hruninu hér á landi og gjaldþrotum fjölskyldna og fyrirtækja

d) eyðilögðuð svo landsfundinum um daginn, líkt og Vilhjálmur Egilsson og Ragnheiður Ríkarðsdóttir hafa bent á, með því að hleypa Davíð í pontu. Big mistake.

e) Landsfundurinn klúðraði svo enn frekar málum með því að hrekja frá sér alla þá Sjálfstæðismenn sem standa í rekstri og tilheyra atvinnulífinu með því að fylkja sér um krónuna og sérhagsmuni kvótagreifa og annarra kónga og flokkseiganda. Flokkurinn sveik grasrótina og flæmdi lýðræðislega evrópusinna í alla aðra flokka. Big mistake.

f) Sjálfstæðisflokkurinn fékk kaus gæfulegan ungan mann til forystu, Bjarna Ben, en sendi hann svo í kosningar með ónothæfa stefnu fyrir fólkið og fyrirtækin. Hvað var það? Sú stefna gagnaðist aðeins sérhagsmunaöflum flokksins og þjóðin gapti.

Aumingja Bjarni Ben var sendur í kosningar með óbreytta hrunastefnu og misbauð þjóðinni; þetta var eins og að senda mann í byssubardaga vopnaðan hnífi. Bjarni Ben þurfti að vinna stefnu framgöngu sem hann hafði sjálfur talað gegn og leið greinilega fyrir það.

Samfylkingin gerði það sem enginn hefur gert áður, jók við sig fylgi eftir að hafa verið í stuttri vist í ríkisstjórnarsamstarfi með Sjálfstæðisflokki. Það er ekki bara sigur heldur stórsigur:) og gerist ekki hér á landi.

Auðvitað verður nú farið beint í aðildarviðræður við ESB og svo kýs þjóðin um niðurstöðu þessa viðræðna þegar þær liggja fyrir. Einfalt og lýðræðislegt.

Sú var tíðin að fólk treysti stjórnmálaflokkum, sérstaklega Sjálfstæðisflokki, til að ákveða hvað þeim væri fyrir bestu í nánast öllum málum. En það var í góðæri og sá tími er auðvita blessunarlega liðinn nú í ljósi hrunsins og því siðrofi sem orðið hefur milli þjóðarinnar og Sjálfstæðisflokksins.

Eina vitið fyrir gamla flokkinn minn (sem er ekki lengur til) er að fara í mikla og djúpa sjálfskoðun og sýna auðmýkt og iðrun (sem Davíð bannaði með öllu).

Bjarni Ben þarf að hreinsa til og losa sig við náhirðina og flokkseigendurnar og hreinlega útrýma þessum öflum innan flokksins (including Bjössa frænda og Co) enda hafa þau þegar kostað hann mikla niðurlægingu.

Ef þetta gerist ekki og það hratt þá nær X-D aldrei fyrri hæðum og styrk, það er klárt, því flokkurinn á ekkert goodwill inni hjá almenningi í dag og næstu árin.

Ég hef trú á Bjarna Ben en ég óttast mest að náhirðin gangi af honum pólitískt dauðum áður en hann nær þessu í gegn.

Þetta verður slagur upp á líf og dauða, bæði fyrir Bjarna og grasrótina vs. Náhirðina og sérhagsmunaöflin.

Þetta kemur í ljós en eins og er þá lítur þetta afar illa út.

Framtíð X-D er í húfi.

Ragnhildur (IP-tala skráð) 26.4.2009 kl. 16:13

Ágætur pistill hjá þér Gunnar. Ég dáist af baráttugleði þinni.

Það er hins vegar ljóst að þrátt fyrir niðurstöður kosninganna þá skal haldið til Brussel í boði fjölmiðla, samtaka atvinnulífsins, Samfylkingarinnar, ,,nýfrjálshyggjuaflanna" innan Sjálfstæðisflokksins o.fl. Sjálfstæðissinnar eru gerðir tortryggilegir og úthrópaðir sem einangrunarsinnar eða eitthvað þaðan af verra. Skynsemisraddir komast ekki að.

ESB lestin er farin af stað ...

Jón Baldur Lorange, 26.4.2009 kl. 17:43

Gunnar, ég sé að við erum sammála í einu og öllu (sjá Samfylkingin dregur fólk og fjölmiðla á asnaeyrunum). Ríflega 70% þjóðarinnar vill ekki fara leið Samfylkingarinnar, en það er samt Samfylkingarleiðin sem vann samkvæmt fjölmiðlum. Ég skil ekki svona röksemdarfærslu.

Mér finnst líka merkilegt að sjá Samfylkingarfólk ráðast inn á svona á færslur með samhengislausan málflutning.

Í mínum huga voru VG og Borgarahreyfingin sigurvegarar kosninganna, Framsókn var ekki langt undan og loks kom Samfylkingin. Mér finnst niðurstaðan varðandi Samfylkinguna sýna mér að þangað sækir klárinn sem hann er kvaldastur. Það er staðreynd að Samfylkingin tók hér við góðu búi fyrir tveimur árum. Hún svaf á vaktinni, eins og Sjálfstæðisflokkurinn og við erum að líða fyrir það í dag.

Marinó G. Njálsson, 26.4.2009 kl. 19:23

Þakka ykkur öllum innlitið.

Ég var að koma úr kaffiboði hér í DK þar sem rætt var um að Danir vildu ekki að "afdalamenn" í mið og suður Evrópu myndu koma nálægt peningastefnu og peningastjórn Danmerkur. Að þessi málefni dönsku þjóðarinnar væru of mikilvæg til þess að láta aðra um þau. Vitnað var í forstjóra fjárfestingabankans Saxo Bank. Þetta voru hans ummæli um það myntbandalag sem er að koma mörgum þjóðum Evrópu á hausinn núna. Þessi maður er núna virkur meðlimur í Alþýðuhreyfingu ESB andstæðinga hér í Danmörku.

Eru margir íslenskir bankastjórar með í Heimssýn, samtökum sjálfstæðissinna á Íslandi? Hvað haldið þið að margir bankastjórar alþjóðlegra fjárfestingabanka séu í Heimssýn á Íslandi núna?

Auðvitað voru það Vinstri Grænir sem unnu kosningarnar. Að segja annað er raklaus og algerlega blautur þvættingur.

Samfylkingin tapaði einnig kosningunum því án 3% Ómarsfylgi hefði hún minnkað.

Það verður fróðlegt að sjá hvor nýju reglurnar um kaup og sölu á vændi nái einnig yfir efnda-rekstur stjórnmálaflokka og stefnu þeirra. Framsókn hef ég því miður ekki mikla trú á því sá flokkur hefur svo mikla og langa reynslu í útgerð vændishúsa stjórnmála. Mun Samfylkingin verða bönnuð? Gæti það gerst?

En hvernig er þetta. Fáum við ekki að kjósa aftur? Að hætti Evrópusambandsins Kjósa aftur og aftur? Nú, ekki það nei

KJÓSUM AFTUR

KJÓSUM AFTUR

OG AFTUR

Kveðjur

Gunnar Rögnvaldsson, 26.4.2009 kl. 20:56

VG náðu að auka fylgi sit meira en 50% og geri aðrir betur. Auðvitað eru þeir sigurvegarar kosninganna.

Það er hins vegar engan veginn tryggt að þeir láti ekki undan þrýstingi frá Samfylkingunni varðandi inngöngu í ESB. Stólar í hlýju valdsins geta verið svo tælandi þegar maður hefur staðið úti í hraglandanum svona lengi.

Copy/paste takkinn á tölvunni hennar nöfnu minnar hér að ofan er vel nýttur. Pistillinn hefur verið að flækjast um eyjunni.is í dag.

Ragnhildur Kolka, 26.4.2009 kl. 22:23

Þakka þér innlitið Ragnhildur Kolka

.

Já Marinó. Það er kominn tími til að dusta rykið af gömlum fjölmiðlalögum, auðhringamyndun fjölmiðla og úttekt á ríkisútvarpinu. Þessi fjölmiða farsi veður að fara að stoppa

Kveðjur

Gunnar Rögnvaldsson, 26.4.2009 kl. 23:20

Bæta við athugasemd [Innskráning]

Ekki er lengur hægt að skrifa athugasemdir við færsluna, þar sem tímamörk á athugasemdir eru liðin.