Sunnudagur, 16. nóvember 2008

Ingibjörg Sólrún: Bankakerfi Evrópusambandsins ţoldi ekki Íslandsálagiđ

Hryđju verkamenn fjár mála

Sökum ótta sem skapast hefur er ţrír íslenskir bankar sem eru núna á hausnum inni í miđju Evrópusambandinu, hefur utanríkisráđherra Samfylkingarinnar, Ingibjörg Sólrún Gísladóttur, tekiđ ţá ákvörđun ađ bjarga fjármálakerfi ţessara 500 milljón ţegna. Ţessir 500 milljón ţegnar eru sagđir búa í einhverju sambandi viđ eitthvađ sem kallast Evrópusambandiđ

Ađ sögn Ingibjargar er fjármálakerfi ţessa sambands svo lélegt ađ ţađ muni ekki ţola ţađ ađ ţeir samingar sem ţetta samband hefur gert viđ eitt land sem heitir Ísland, og sem er ekki í sambandi viđ ţetta samband, muni standa. Samningar ţessir hafa veriđ grafnir í pappírsdyngjum 170.000 embćttismanna í mörg ár. Ţessir embćttismenn hafa ţó veriđ í stöđugu sambandi viđ Ingibjörgu og bankamálaráđherra hennar í ţessi mörg ár. Ţessir samingar segja svo fyrir um ađ ţađ sé til tryggingasjóđur einn á Íslandi sem eigi og muni standa undir greiđslum til ţeirra sparifjáreigenda sem voru svo vitlausir ađ ganga út frá ađ 170.000 manna embćttismannaher ţessa sambands sem er í sambandi viđ Ingibjörgu á Íslandi, muni sjá til ţess ađ ţeir fái greidda út peninga sína samkćmt ţessum samingum. Athugiđ ađ ţessi 170.000 manna herafli sambandsins er eini herafli sambandsins. Ađ sögn sumra er ţessi her ávalt í viđbragđsstöđu (high alert) tilbúnir til átaka međ blýanta og önnur skrifstofuáhöld ađ vopni og sem ađeins Sósíal-Demó-Kratar fćđast međ af Guđs náđ

Evrópusambandiđ hefur eyđilagt grundvöll heilbrigđrar bankastarfsemi

Ţađ má međ sanni segja ađ 170.000 manna herafli ţessa sambands sem kallar sig Evrópusambandiđ sé mjög áhrifamikill. Á innan viđ 10 árum hefur ţessum her embćttismanna tekist ađ eyđileggja grundvöllinn fyrir heilbrigđum og íhaldssömum bankarekstri í heilum 27 löndum og einnig á Íslandi. En eins og allir vita ţarf bankarekstur ađ vera íhaldssamur ef hann á ađ geta gengiđ upp til lengri tíma en hćgt er ađ mćla međ reglustrikum Evrópusambandsins. Ţannig ađ núna er ţessi rekstur nćstum gjaldţrota út um allt í ţessu sambandi í Evrópu. Ţessum rekstri er núna einungis haldiđ á lífi međ ţví ađ láta launţega, börn og gamlamenni gangast í ábyrgđ fyrir öllum skuldbindingum ţessara banka. Stjórnendur bankanna ganga núna um međ bleyjur fullar ađ peningum skattgreiđenda og míga í ţá

En eftir ađ Ingibjörgu Sólrúnu Gísladóttur og bankamálaráđherra hennar tókst ađ koma bankakerfi Evrópusambandsins á heljarţröm, ţá hefur hún gerst talsmađur fyrir ţví ađ Ísland gangi enn lengra og drepi hreinlega sambandiđ međ ţví ađ hóta ađ ganga í ţađ. En ţetta eru 27 ţjóđir sambandsins og 3 Norđurlönd af 6 mjög hrćdd viđ. Ţessi lönd og hafa ţví leitađ til sér sterkari ađila í Bandaríkjunum og beđiđ ţá um ađ innheimta innistćđur samkvćmt engum-samningum viđ Ísland. Innheimta peningana međ vopnavaldi frá Íslenskum launţegum, börnum og gamalmennum. Viđ ţetta urđu Ingibjörg Sólrún Gísladóttir og bankamálaráđherra hennar svo glöđ ađ ţau ákváđu ađ hćtta viđ ađ gera áhlaup á fjármálakerfi Evrópusambandsins og í stađinn ađ vinna ađ ţví ađ veđsetja Ísland upp í topp og vinna saman međ innheimtustofnuninni alţjóđlegu, stundum skammstafađ IMF, viđ ađ leggja niđur Ísland, enda hefur ţađ veriđ á stefnuskrá Samfylkingarinnar frá upphafi. Greiningadeildir samfylkingarbankanna (núna á hausnum) hafa nefnilega greint ađ Samfylkingin gangi međ ólćknandi sjúkdóm er nefnist Eurosclerosis

Hvađ hefđi veriđ til ráđa?

Ef Seđlabanki Íslands og Davíđ Oddsson hefđu lagt til ađ bankarnir hefđu veriđ reknir úr landi áriđ 2003 eđa ađ öđrum kosti yrđi sett á ţá stór bindiskylda og viđeigandi höft, og krafist ađ sett yrđu á ţá lögbundin sjóđamyndun til ađ mćta stór-töpum, ţá hefđi hann veriđ krossfestur opinberlega - bćđi Seđlabankinn og Davíđ Oddsson, og ţađ alveg persónulega af Ingibjörgu Sólrúnu og bankamálaráđherra hennar. En ţessi krossfesting hefđi ekki bara fariđ fram á Íslandi hjá Samfylkingunni heldur einnig í ESB - musteri Samfylkingarinnar erlendis. Ţessi sjóđamyndun til ađ mćta stór-tapi í bankarekstri var til dćmis felld úr dönskum lögum ţví hún var dćmd sem samkeppnishindrun af Evrópusambandinu (já hvađ annađ). Núna ţarf danska ríkiđ ţví ađ hósta upp ríkisábyrgđ ţessum vesalingarekstri til hjálpar. Og núna ţurfa íslenskir skattgreiđendur ađ borga stóran hluta af ţví sem Seđlabanki Íslands var búinn ađ vara viđ árum saman. En bankamálaráđherra Samfylkingarinnar er heyrnalaus enda međ gular stjörnur í bláum skónum. Seđlabanki Íslands hafđi rétt fyrir sér, en ekki var hlustađ á hann, enda menn heyrnalausir af peningaglamri samfylkingarbankanna og massífri fjölmiđlun ţeirra. Davíđ Oddsson varađi viđ ţessu marg marg oft. En bankamálaráđherrann hlustađi ekki. Í stađinn fékk hann eyrnatappa ađ láni hjá Ingibjörgu Sólrúnu Gísladóttur - og gular stjörnur í skóinn.

Hvađ međ alla hina?

Geta bygginameistarar ekki fengiđ ríkisábyrgđ á Íslandi líka, og tískuverslanir einnig? Hvađ međ pylsusala? Ţeir eiga stundum viđ erfiđleika ađ glíma í rekstri og hafa kanski selt fleiri pylsur en ţeir eiga. Svo gufađi sinnepiđ einnig upp ţegar sólin skein og gasiđ varđ ađ engu í kútnum. Gosiđ í flöskunum reyndist vera loft af verri tegund en greint hafđi veriđ í greiningadeildum. En ţegar ég hef selt pylsuvagninn minn ţá mun ég eiga fyrir öllum ţeim pylsum sem ég seldi en sem ég átti ekki. Svo ţađ er góđ "von" til ţess ađ allir fái sínar pylsur aftur međ rúsínum í endanum á sér. Ykkur er ţví alveg óhćtt ađ skrifa uppá fyrir MIG. Ég vona nefnilega ţví ég kann svo vel bankastarfsemi upp á von og ótta, en ţó mest ótta - eđa var ţađ vonin, ég man ţađ ekki lengur

En núna stakk Evrópusambandiđ sér á kaf ofaní seđlaveski Íslendinga, um mörg ókomin ár - launţegar, börn og gamlamenni. Röriđ sem er haldiđ hinum óslökkvandi ţorsta - ţađ kom sá og sigrađi. Til hamingju Íslendingar, núna eruđ ţiđ međ í sambandinu. Loksins!

Gerum eitthvađ annađ © Samfylkingin

|

Skilabođin voru skýr |

| Tilkynna um óviđeigandi tengingu viđ frétt | |

Flokkur: Stjórnmál og samfélag | Breytt 18.11.2008 kl. 10:55 | Facebook

Nýjustu fćrslur

- Ég óska Bjarna Ben til hamingju og velfarnađar

- Víkingar unnu ekki. Ţeir "ţáđu ekki störf"

- Engir rafbílar segir Apple

- Grafa upp gamlar sprengjur og senda áleiđis til Úkraínu

- Geđsýki rćđur NATÓ-för

- "Ađ sögn" háttsettra í loftbelg

- Skuldir Bandaríkjanna smámunir miđađ viđ allt hitt

- Forsetinn og meiri-hluta-ţvćttingurinn

- Gervigreindar-fellibyl í vatnsglösum lokiđ

- Sjálfstćđ "Palestína" sýnir morđgetu sína á tvo kanta

- Benjamín Netanyahu hringdi strax í Zelensky. Hvers vegna?

- Hlýtur ađ vera Rússum ađ kenna [u]

- Ţjóđverji međ ónýta mynt á Zetros

- Hvađ er gervigreind?

- Kengruglađir grćnkommar

Bloggvinir

-

Heimssýn

Heimssýn

-

Samtök Fullveldissinna

Samtök Fullveldissinna

-

ÞJÓÐARHEIÐUR - SAMTÖK GEGN ICESAVE

ÞJÓÐARHEIÐUR - SAMTÖK GEGN ICESAVE

-

Guðmundur Jónas Kristjánsson

Guðmundur Jónas Kristjánsson

-

Ragnhildur Kolka

Ragnhildur Kolka

-

Hannes Hólmsteinn Gissurarson

Hannes Hólmsteinn Gissurarson

-

Haraldur Hansson

Haraldur Hansson

-

Haraldur Baldursson

Haraldur Baldursson

-

Páll Vilhjálmsson

Páll Vilhjálmsson

-

Halldór Jónsson

Halldór Jónsson

-

Valan

Valan

-

Samstaða þjóðar

Samstaða þjóðar

-

Frjálshyggjufélagið

Frjálshyggjufélagið

-

Sigríður Laufey Einarsdóttir

Sigríður Laufey Einarsdóttir

-

Eyþór Laxdal Arnalds

Eyþór Laxdal Arnalds

-

Jón Valur Jensson

Jón Valur Jensson

-

Samtök um rannsóknir á ESB ...

Samtök um rannsóknir á ESB ...

-

Kolbrún Stefánsdóttir

Kolbrún Stefánsdóttir

-

Vilhjálmur Örn Vilhjálmsson

Vilhjálmur Örn Vilhjálmsson

-

Jón Baldur Lorange

Jón Baldur Lorange

-

Guðjón E. Hreinberg

Guðjón E. Hreinberg

-

Jón Ríkharðsson

Jón Ríkharðsson

-

Anna Björg Hjartardóttir

Anna Björg Hjartardóttir

-

Loftur Altice Þorsteinsson

Loftur Altice Þorsteinsson

-

Valdimar Samúelsson

Valdimar Samúelsson

-

Fannar frá Rifi

Fannar frá Rifi

-

Bjarni Jónsson

Bjarni Jónsson

-

Sigurður Þorsteinsson

Sigurður Þorsteinsson

-

Gunnar Ásgeir Gunnarsson

Gunnar Ásgeir Gunnarsson

-

Haraldur Haraldsson

Haraldur Haraldsson

-

Örvar Már Marteinsson

Örvar Már Marteinsson

-

Kristin stjórnmálasamtök

Kristin stjórnmálasamtök

-

Gestur Guðjónsson

Gestur Guðjónsson

-

Ingvar Valgeirsson

Ingvar Valgeirsson

-

Predikarinn - Cacoethes scribendi

Predikarinn - Cacoethes scribendi

-

Guðsteinn Haukur Barkarson

Guðsteinn Haukur Barkarson

-

Guðmundur Helgi Þorsteinsson

Guðmundur Helgi Þorsteinsson

-

Lísa Björk Ingólfsdóttir

Lísa Björk Ingólfsdóttir

-

Bjarni Kjartansson

Bjarni Kjartansson

-

Bjarni Harðarson

Bjarni Harðarson

-

Guðrún Sæmundsdóttir

Guðrún Sæmundsdóttir

-

Sveinn Atli Gunnarsson

Sveinn Atli Gunnarsson

-

gudni.is

gudni.is

-

Gústaf Adolf Skúlason

Gústaf Adolf Skúlason

-

Tryggvi Hjaltason

Tryggvi Hjaltason

-

ESB

ESB

-

Marinó G. Njálsson

Marinó G. Njálsson

-

Baldvin Jónsson

Baldvin Jónsson

-

Elle_

Elle_

-

Sigurbjörn Svavarsson

Sigurbjörn Svavarsson

-

Emil Örn Kristjánsson

Emil Örn Kristjánsson

-

Johnny Bravo

Johnny Bravo

-

Jón Finnbogason

Jón Finnbogason

-

Rýnir

Rýnir

-

Þórarinn Baldursson

Þórarinn Baldursson

-

P.Valdimar Guðjónsson

P.Valdimar Guðjónsson

-

Már Wolfgang Mixa

Már Wolfgang Mixa

-

Ívar Pálsson

Ívar Pálsson

-

Júlíus Björnsson

Júlíus Björnsson

-

Guðjón Baldursson

Guðjón Baldursson

-

Baldur Fjölnisson

Baldur Fjölnisson

-

Ingibjörg Álfrós Björnsdóttir

Ingibjörg Álfrós Björnsdóttir

-

Einar Ólafsson

Einar Ólafsson

-

Sigríður Jósefsdóttir

Sigríður Jósefsdóttir

-

Vilhjálmur Árnason

Vilhjálmur Árnason

-

gummih

gummih

-

Sveinn Tryggvason

Sveinn Tryggvason

-

Helga Kristjánsdóttir

Helga Kristjánsdóttir

-

Jóhann Elíasson

Jóhann Elíasson

-

Baldur Hermannsson

Baldur Hermannsson

-

Kristinn D Gissurarson

Kristinn D Gissurarson

-

Magnús Jónsson

Magnús Jónsson

-

Ketill Sigurjónsson

Ketill Sigurjónsson

-

Birgitta Jónsdóttir

Birgitta Jónsdóttir

-

Axel Jóhann Axelsson

Axel Jóhann Axelsson

-

Þorsteinn Helgi Steinarsson

Þorsteinn Helgi Steinarsson

-

Aðalsteinn Bjarnason

Aðalsteinn Bjarnason

-

Magnús Þór Hafsteinsson

Magnús Þór Hafsteinsson

-

Erla Margrét Gunnarsdóttir

Erla Margrét Gunnarsdóttir

-

Sigurður Sigurðsson

Sigurður Sigurðsson

-

Þorsteinn H. Gunnarsson

Þorsteinn H. Gunnarsson

-

Haraldur Pálsson

Haraldur Pálsson

-

Sveinbjörn Kristinn Þorkelsson

Sveinbjörn Kristinn Þorkelsson

-

Bjarni Benedikt Gunnarsson

Bjarni Benedikt Gunnarsson

-

Jakobína Ingunn Ólafsdóttir

Jakobína Ingunn Ólafsdóttir

-

Ægir Óskar Hallgrímsson

Ægir Óskar Hallgrímsson

-

Helgi Kr. Sigmundsson

Helgi Kr. Sigmundsson

-

Óskar Sigurðsson

Óskar Sigurðsson

-

Tómas Ibsen Halldórsson

Tómas Ibsen Halldórsson

-

Axel Þór Kolbeinsson

Axel Þór Kolbeinsson

-

Kjartan Pétur Sigurðsson

Kjartan Pétur Sigurðsson

-

Hörður Valdimarsson

Hörður Valdimarsson

-

Adda Þorbjörg Sigurjónsdóttir

Adda Þorbjörg Sigurjónsdóttir

-

Þorsteinn Valur Baldvinsson

Þorsteinn Valur Baldvinsson

-

Margrét Elín Arnarsdóttir

Margrét Elín Arnarsdóttir

-

Ásta Hafberg S.

Ásta Hafberg S.

-

Erla J. Steingrímsdóttir

Erla J. Steingrímsdóttir

-

Helena Leifsdóttir

Helena Leifsdóttir

-

Agný

Agný

-

Brosveitan - Pétur Reynisson

Brosveitan - Pétur Reynisson

-

Jón Árni Bragason

Jón Árni Bragason

-

Jón Lárusson

Jón Lárusson

-

Högni Snær Hauksson

Högni Snær Hauksson

-

Kristján P. Gudmundsson

Kristján P. Gudmundsson

-

Kristinn Snævar Jónsson

Kristinn Snævar Jónsson

-

Sigurður Ingólfsson

Sigurður Ingólfsson

-

Rakel Sigurgeirsdóttir

Rakel Sigurgeirsdóttir

-

Sigurður Þórðarson

Sigurður Þórðarson

-

S. Einar Sigurðsson

S. Einar Sigurðsson

-

Pétur Steinn Sigurðsson

Pétur Steinn Sigurðsson

-

Vaktin

Vaktin

-

Sigurjón Sveinsson

Sigurjón Sveinsson

-

Dóra litla

Dóra litla

-

Arnar Guðmundsson

Arnar Guðmundsson

-

Jörundur Þórðarson

Jörundur Þórðarson

-

Rafn Gíslason

Rafn Gíslason

-

Hjalti Sigurðarson

Hjalti Sigurðarson

-

Kalikles

Kalikles

-

Vésteinn Valgarðsson

Vésteinn Valgarðsson

-

Bjarni Kristjánsson

Bjarni Kristjánsson

-

Egill Helgi Lárusson

Egill Helgi Lárusson

-

Gunnar Skúli Ármannsson

Gunnar Skúli Ármannsson

-

Halldóra Hjaltadóttir

Halldóra Hjaltadóttir

-

Jón Pétur Líndal

Jón Pétur Líndal

-

Guðmundur Ásgeirsson

Guðmundur Ásgeirsson

-

Reputo

Reputo

-

Gunnar Helgi Eysteinsson

Gunnar Helgi Eysteinsson

-

Sigurður Sigurðsson

Sigurður Sigurðsson

-

Ólafur Als

Ólafur Als

-

Friðrik Már

Friðrik Már

-

Gísli Sigurðsson

Gísli Sigurðsson

-

Sigurður Einarsson

Sigurður Einarsson

-

Rauða Ljónið

Rauða Ljónið

-

Sumarliði Einar Daðason

Sumarliði Einar Daðason

-

Gísli Kristbjörn Björnsson

Gísli Kristbjörn Björnsson

-

Kári Harðarson

Kári Harðarson

-

Sigurður Antonsson

Sigurður Antonsson

-

Valdimar H Jóhannesson

Valdimar H Jóhannesson

-

Rósa Aðalsteinsdóttir

Rósa Aðalsteinsdóttir

-

Dagný

Dagný

-

Guðmundur Pálsson

Guðmundur Pálsson

-

Jakob Þór Haraldsson

Jakob Þór Haraldsson

-

Birgir Viðar Halldórsson

Birgir Viðar Halldórsson

-

Magnús Ragnar (Maggi Raggi).

Magnús Ragnar (Maggi Raggi).

-

Tíkin

Tíkin

-

Jón Þórhallsson

Jón Þórhallsson

-

Íslenska þjóðfylkingin

Íslenska þjóðfylkingin

-

Erla Magna Alexandersdóttir

Erla Magna Alexandersdóttir

-

Óskar Kristinsson

Óskar Kristinsson

-

Dominus Sanctus.

Dominus Sanctus.

-

Ingólfur Sigurðsson

Ingólfur Sigurðsson

-

Jón Þórhallsson

Jón Þórhallsson

Tenglar

Hrađleiđir

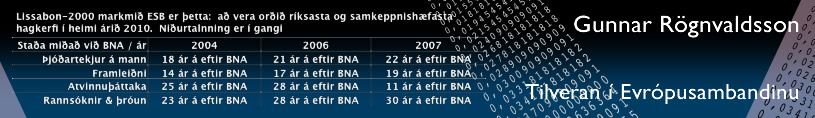

- www.tilveraniesb.net www.tilveraniesb.net Vefsetur Gunnars Rögnvaldssonar

- www.mbl.is

- Donald J. Trump: Blogg - tilkynningar og fréttir Donald J. Trump: Blogg - tilkynningar og fréttir

- Bréf frá Jerúsalem - Yoram Hazony Yoram Hazony er einn fremsti stjórnmálaheimspekingur Vesturlanda í dag

- NatCon Ţjóđaríhaldsstefnan

- Victor Davis Hanson bóndi og sagnfræðingur Victor Davis Hanson er einn fremsti sagnfrćđingur Vesturlanda í klassískri sögu og hernađi

- Bruce Thornton sagnfræðingur Bruce Thornton er sagnfrćđingur - klassísk frćđi

- Geopolitical Futures - geopólitík Vefsetur George Friedmans sem áđur hafi stofnađ og stjórnađ Stratfor

- Strategika Geopólitík

- TASS

- Atlanta Fed EUR credit & CDS spreads

- N.Y. Fed EUR charts

- St. Louis Fed USD Index Federal Reserve Bank of St. Louis - Trade Weighted U.S. Dollar Index: Major Currencies

- Atvinnuleysi í Evrópusambandinu núna: og frá 1983 Atvinnuleysi í Evrópusambandinu núna: og frá 1983

Ţekkir ţú ESB?

Greinar

Lestu mig

Lestu mig

• 99,8% af öllum fyrirtćkjum í ESB eru lítil, minni og millistór fyrirtćki (SME)

• Ţau standa fyrir 81,6% af allri atvinnusköpun í ESB

• Ađeins 8% af ţessum fyrirtćkjum hafa viđskipti á milli innri landamćra ESB

• Ađeins 12% af ađföngum ţeirra eru innflutt og ađeins 5% af ţessum fyrirtćkjum hafa viđskiptasambönd í öđru ESB-landi

• Heimildir »» EuroChambers og University of LublianaSciCenter - Benchmarking EU

Bćkur

Á náttborđunum

-

: EU - Europas fjende (ISBN: 9788788606416)

Evrópusambandiđ ESB er ein versta ógn sem ađ Evrópu hefur steđjađ. -

: World Order (ISBN: 978-1594206146)

There has never been a true “world order,” Kissinger observes. For most of history, civilizations defined their own concepts of order. -

: Íslenskir kommúnistar (ISBN: ISBN 978-9935-426-19-2)

Almenna bókafélagiđ gefur út. -

: Velstandens kilder:

Um uppsprettu velmegunar Evrópu - : Paris 1919

- : Reagan

- : Stalin - Diktaturets anatomi

-

: Penge

Ungverjinn segir frá 70 ára kauphallarreynslu sinni -

: Gulag og glemsel

Um sorgleik Rússlands og minnistap vesturlanda - : Benjamín H. J. Eiríksson

- : Opal

- : Blár

Heimsóknir

Flettingar

- Í dag (20.4.): 17

- Sl. sólarhring: 27

- Sl. viku: 170

- Frá upphafi: 1381431

Annađ

- Innlit í dag: 12

- Innlit sl. viku: 117

- Gestir í dag: 8

- IP-tölur í dag: 6

Uppfćrt á 3 mín. fresti.

Skýringar

Eldri fćrslur

- Apríl 2024

- Febrúar 2024

- Janúar 2024

- Nóvember 2023

- Október 2023

- September 2023

- Ágúst 2023

- Júní 2023

- Maí 2023

- Apríl 2023

- Mars 2023

- Febrúar 2023

- Janúar 2023

- Nóvember 2022

- Október 2022

- September 2022

- Ágúst 2022

- Júlí 2022

- Júní 2022

- Apríl 2022

- Mars 2022

- Febrúar 2022

- Janúar 2022

- Desember 2021

- Október 2021

- September 2021

- Júlí 2021

- Mars 2021

- Febrúar 2021

- Janúar 2021

- Desember 2020

- Nóvember 2020

- Október 2020

- September 2020

- Ágúst 2020

- Júlí 2020

- Júní 2020

- Maí 2020

- Apríl 2020

- Mars 2020

- Febrúar 2020

- Janúar 2020

- Desember 2019

- Nóvember 2019

- Október 2019

- September 2019

- Ágúst 2019

- Júlí 2019

- Júní 2019

- Maí 2019

- Apríl 2019

- Mars 2019

- Febrúar 2019

- Janúar 2019

- Desember 2018

- Nóvember 2018

- Október 2018

- September 2018

- Ágúst 2018

- Júlí 2018

- Júní 2018

- Maí 2018

- Apríl 2018

- Mars 2018

- Febrúar 2018

- Janúar 2018

- Desember 2017

- Nóvember 2017

- Október 2017

- September 2017

- Ágúst 2017

- Júlí 2017

- Júní 2017

- Maí 2017

- Apríl 2017

- Mars 2017

- Febrúar 2017

- Janúar 2017

- Desember 2016

- Nóvember 2016

- Október 2016

- September 2016

- Ágúst 2016

- Júlí 2016

- Júní 2016

- Maí 2016

- Apríl 2016

- Mars 2016

- Febrúar 2016

- Janúar 2016

- Desember 2015

- Nóvember 2015

- Október 2015

- September 2015

- Ágúst 2015

- Júlí 2015

- Júní 2015

- Maí 2015

- Apríl 2015

- Mars 2015

- Febrúar 2015

- Janúar 2015

- Desember 2014

- Nóvember 2014

- Október 2014

- September 2014

- Ágúst 2014

- Júlí 2014

- Júní 2014

- Maí 2014

- Apríl 2014

- Mars 2014

- Febrúar 2014

- Janúar 2014

- Desember 2013

- Nóvember 2013

- Október 2013

- September 2013

- Ágúst 2013

- Júlí 2013

- Júní 2013

- Maí 2013

- Apríl 2013

- Mars 2013

- Febrúar 2013

- Janúar 2013

- Desember 2012

- Nóvember 2012

- Október 2012

- September 2012

- Ágúst 2012

- Júlí 2012

- Júní 2012

- Maí 2012

- Apríl 2012

- Mars 2012

- Febrúar 2012

- Janúar 2012

- Desember 2011

- Nóvember 2011

- Október 2011

- September 2011

- Ágúst 2011

- Júlí 2011

- Júní 2011

- Maí 2011

- Apríl 2011

- Mars 2011

- Febrúar 2011

- Janúar 2011

- Desember 2010

- Nóvember 2010

- Október 2010

- September 2010

- Ágúst 2010

- Júlí 2010

- Júní 2010

- Maí 2010

- Apríl 2010

- Mars 2010

- Febrúar 2010

- Janúar 2010

- Desember 2009

- Nóvember 2009

- Október 2009

- September 2009

- Ágúst 2009

- Júlí 2009

- Júní 2009

- Maí 2009

- Apríl 2009

- Mars 2009

- Febrúar 2009

- Janúar 2009

- Desember 2008

- Nóvember 2008

- Október 2008

- September 2008

- Ágúst 2008

- Júlí 2008

- Júní 2008

- Maí 2008

House of COMMONS MINUTES OF EVIDENCE

House of COMMONS MINUTES OF EVIDENCE

Athugasemdir

Ţetta er ekki bođlegur málflutningur hjá Ingibjörgu Sólrúnu og Geir Haarde.

Gćttu ađ öđru - Allur ţessi Evrópusambandsađildaarvađall er ekki nein tilviljun en Geir Haarde og Ingibjög Sólrún eru međ ţessu ađ reyna ađ láta umrćđuna snúast um allt annađ en eigin ábyrgđa á hruninu og ţví ađ allt liđiđ sem klúđrađi málum er á fullum launum hjá ríkinu.

Sigurjón Ţórđarson, 17.11.2008 kl. 00:24

Hvađ ćtli margir Íslendingar hafi vitađ um ţessa 20.000 Evra ábyrgđ ? Hvađ ćtli margir Alţingismenn hafi vitađ um ţessa ábyrgđ ? Hvađ vissu margir Íslendskir ráđherrar um ţennan bagga ? Ekki vissi ég um ábyrgđina og á ég ţó hlut í einum ţjóđnýtta bankanum og hef fariđ á fjölmarga hluthafa-fundi hjá öllum bönkunum.

Ţađ vćri annars fróđlegt ađ vita hvenćr ESB lćddi inn ţessari tilskipun. Var hún nokkurn-tíma samţykkt á Alţingi ? Getur veriđ ađ einhverjir Íslendingar leggi til ađ viđ sćkjum fastar í fađm ESB ? Vćri ekki nćr ađ forđa sér út af Evrópska efnahagssvćđinu áđur en ţađ drepur okkur öll ?

Loftur Altice Ţorsteinsson, 17.11.2008 kl. 00:32

Kíktu á útreikningana hjá mér. Ţeir skýra hvernig kostnađurinn leggst á okkur og hversu mikill hann er.

4,5% vextir af IMF og Icesave í 10 ár, greitt einu sinni á ári afborgun, ţýđir 2,2 milljarđa dala í vaxtagreiđslur.

Fannar frá Rifi, 17.11.2008 kl. 01:01

Ţetta er nákvćmlega máliđ, Gunnar.

Ég hef einmitt veriđ ađ velta fyrir mér ţessu međ bindiskylduna ţ.e. afhverju hún var ekki sett á bankana ţví hún er eitt af fáum tćkjum sem Seđlabanki Íslands hafđi til ađ sporna viđ vexti bankanna.

En ţú bendir einmitt á skýringuna. Seđlabankanum hefur sennilega veriđ hótađ međ lögsókn byggđa á samningum um EES ađ ef ţađ vćri gert ţá vćri samkeppnisstađan viđ lönd ESB ójöfn.

Getur veriđ ađ ţessi ákvörđun hafi veriđ afdrifarík sem ég fann á vef Seđlabanka Íslands. Hún var birt á vefnum í mars 2008.

Takiđ eftir ađ ţarna er sérstaklega veriđ ađ létta á bindiskyldu banka sem starfrćkja útibú erlendis. IceSave var í útibúi Landsbankans í Hollandi og Bretlandi. Ţýđir ţetta ekki ađ í mars 2008 var veriđ ađ ýta UNDIR útibú í stađ ţess ađ draga úr og stofna dóttturfélög? Úps!

Egill Jóhannsson, 17.11.2008 kl. 01:13

UNCORRECTED TRANSCRIPT OF ORAL EVIDENCE To be published as HC 1008-ii

House of COMMONS

MINUTES OF EVIDENCE

TAKEN BEFORE

TREASURY COMMITTEE

BANKING REFORM

Tuesday 22 July 2008

MR MERVYN KING, SIR JOHN GIEVE,

MR NIGEL JENKINSON and MR ANDREW BAILEY

KITTY USSHER MP, MR CLIVE MAXWELL and MR EMIL LEVENDOĞLU

Evidence heard in Public Questions 123 - 309

USE OF THE TRANSCRIPT

1.

This is an uncorrected transcript of evidence taken in public and reported to the House. The transcript has been placed on the internet on the authority of the Committee, and copies have been made available by the Vote Office for the use of Members and others.

2.

Any public use of, or reference to, the contents should make clear that neither witnesses nor Members have had the opportunity to correct the record. The transcript is not yet an approved formal record of these proceedings.

3.

Members who receive this for the purpose of correcting questions addressed by them to witnesses are asked to send corrections to the Committee Assistant.

4.

Prospective witnesses may receive this in preparation for any written or oral evidence they may in due course give to the Committee.

Oral Evidence

Taken before the Treasury Committee

on Tuesday 22 July 2008

Members present

John McFall, in the Chair

Nick Ainger

Mr Graham Brady

Jim Cousins

Mr Philip Dunne

Mr Michael Fallon

Ms Sally Keeble

John Thurso

Mr Mark Todd

________________

Witnesses: Mr Mervyn King, Governor, Sir John Gieve, Deputy Governor for Financial Stability, Mr Nigel Jenkinson, Executive Director, Financial Stability, and Mr Andrew Bailey, Executive Director, Banking Services, and Chief Cashier, Bank of England, gave evidence.

Q123 Chairman: Governor, good morning to you and your colleagues on this evidence session on banking. They are very familiar appearances you are making at the Treasury Committee and you are even making one on 11 September when we are in recess so we look forward to that one as well. Can you introduce your colleagues for the shorthand writer please?

Mr King: Good morning, Chairman. On my right is Sir John Gieve, Deputy Governor for Financial Stability. On his right is Nigel Jenkinson, Executive Director for Financial Stability, who has been working very much on the Banking Bill and the consultation documents under John's leadership, and on my left is Andrew Bailey, Executive Director for Banking, who is very much involved in all relationships between the Bank of England and commercial banks.

Q124 Chairman: Welcome. When you were here in April you mentioned to us that you were determined that the Bank should accept new obligations only if it was granted sufficient powers to meet them. What do you see as your likely new obligations and will your new powers match them?

Mr King: Clearly the new obligation that has been suggested in the consultation documents given to the Bank is the management of the Special Resolution Regime for failing banks. That mirrors in many ways your own recommendations in your report in January. I think the consultation documents that we have seen so far do give the Bank adequate powers to implement that regime, though, of course, we have yet to see legislation and it is yet to be debated in Parliament and to be passed, so, as ever, the devil will be in the detail, but in the broad intentions in the document I think the Bank has been granted the powers to manage that regime.

Q125 Chairman: In practice what difference will it make to the Bank's work when it has a statutory duty for financial stability?

Mr King: I think it will make quite a major difference to the Bank of England. In the period before last summer I think it is fair to say that we adopted the view which was given to us under the Memorandum of Understanding that the role of the Bank of England was really not to get involved with individual institutions at any point. That has now clearly changed. It was not the view which most people seemed to take in the autumn should be our position, and what this regime now gives us is a responsibility not to supervise banks, not to get involved in great detail in banks in peacetime when there are no obvious problems, but as soon as there are potential question marks about the health of a bank we will need - and the FSA have made it very clear that they would share all the data with us - to be involved in understanding the condition of that bank in order that we would be able to make a judgment, a recommendation, if necessary, to the FSA to have the bank be put into the Special Resolution Regime and to take control of that bank in the regime were it necessary to do so.

Q126 Chairman: It is clear from the evidence of Sir John Parker last week that many aspects of the Special Resolution Regime are still to be clarified. Do you think that the Government's thinking is sufficiently advanced to enable legislation to be published in October?

Mr King: It is certainly sufficiently advanced to enable legislation to be published in October. There will, of course, be a great deal of detail that will need to be thought through and examined very carefully. That is your responsibility together with the House and I hope that you will take the time to do that and devote enough resources to it. I think there is a lot of detail still to be discussed, and the precise powers that the Bank will have and how the regime will work I do not think can be fully deduced from the degree of detail that has been published so far, so there is still a lot to play for.

Q127 Chairman: That certainly came out in our evidence session last week and that is what concerns us, particularly when the powers to take public control of banks under the Banking (Special Provisions) Act 2008 will lapse in late February. Given that situation, do you think it will be possible for the powers under the new Special Resolution Regime to be ready by then? I would not like to think that everything has got to be worked up to February because we will get a very complex piece of legislation and in ensuring that we comply by a particular date we may miss the bigger picture in that we have legislation which is fit for purpose.

Mr King: I certainly think it is more important to get it right than to rush it to a fixed timetable. That clearly must be the case. Whether or not that timetable will prove to be feasible I think is too early to judge now. I see no harm in trying to meet that timetable, but whether or not it will be feasible will depend very much on your and your colleagues in Parliament as to whether you feel you have had enough time to debate the details. They must be got right and it would be a mistake to rush it. I would rather take more time to get it right than rush it.

Q128 Mr Todd: One of the areas which certainly requires some further definition is the role of the Financial Stability Committee. You may have read the evidence when we questioned Sir John Parker on aspects of that previously. What do you think the function of that committee is? Is it an executive committee to handle specific circumstances and to drive policy and to direct the executive of the Bank? Is it an advisory body? What exactly is it going to do, do you think?

Mr King: Let me try and spell out how I think it would work in practice and then we can decide what label you wish to attach to it. What I envisage is that, in contrast to monetary policy, where there is a very clear single decision, single instrument and a timetable to make those decisions which need not vary, financial stability is a very different kettle of fish altogether. The issues involved are many and varied. There is no one-dimensional policy instrument. I think you can divide the work into two kinds. We would intend to involve the Financial Stability Committee in discussions of both kinds, and indeed in all the work of the Bank in financial stability, so I think there are two kinds of work. One is the structural work where you are not working to an immediate timetable determined by the problems of a crisis. You are thinking through a structural reform, how would we implement and manage the Special Resolution Regime, how does lender of last resort support work in practice, how would we design the new regime for regulation of payment systems, which is another responsibility that the Bank will be given. We would have discussed with the committee the Special Liquidity Scheme; we did with Court, but we would discuss it in more detail with the Financial Stability Committee and the successor to that scheme. All of these issues are important to financial stability but they are not done to a particular timetable. They are issues that we need to think through. My view of this committee is that the executive and non-executive members on the Financial Stability Committee would sit together and debate at some length all the issues that go into it. I think in the end the executive members will have to take responsibility. I do not think non-executive members of Court are there to second-guess the policy judgments of the executive, and I do not think you can really expect them to be held responsible for a lot of the detail of it; it is not their task to do it, but I do think that they have to be comfortable with it. I would not myself want to proceed with any of these structural issues unless I felt the Financial Stability Committee were comfortable with that. Nevertheless, in the end this committee is going to hold me and the other executive members accountable for what the Bank does. We will be held responsible for it. The accountability of this kind of work of the Financial Stability Committee will be done as other Court committees often do it. All the detail will be discussed with the executive members and the non-executive members will be able to report back to Court as to whether or not they think the executive is doing a competent and professional job. If not they can raise question marks.

Q129 Mr Todd: So, in answer to my question - that was a very helpful answer -----

Mr King: Can I go on to the emergency actions, which is the other part of the work? On that one, again, we would discuss with the Financial Stability Committee each individual case, daily if necessary. You cannot expect Court to do that but I think the Financial Stability Committee would have to be prepared to meet daily if necessary, but we on the executive will be meeting all day dealing with a crisis. There has to be some delegation of decisions in a crisis to the executive, Court understands that, but insofar as possible we would certainly take every decision to the Financial Stability Committee, and I myself would not want to recommend to the Chancellor that the Bank would be willing to support an action if the Financial Stability Committee felt that the use of the Bank's balance sheet was too risky, for example. If the FSC was not willing to support that action I would say to the Chancellor, "Look, if you want to go ahead with this then it will have to be at the cost to the Government, not the Bank". I do think that the Financial Stability Committee has a very big say here, but in the final resort you and others are going to hold us accountable.

Q130 Mr Todd: Indeed, so you have defined a role of forceful, high-powered advice and scrutiny?

Mr King: Yes, exactly.

Q131 Mr Todd: Challenging, probing but not accountable for decisions that may be made? Those are essentially the duty of the executive and the Government?

Mr King: Yes, but I do think that the non-executive members of the FSC will be reporting back to Court on whether they think the executive have handled the matter competently and professionally because they will have seen us in action in some detail in a way that Court will not.

Q132 Mr Todd: So in this slightly unusual body you will also have seen that there was some questioning of your own role?

Mr King: Indeed.

Q133 Mr Todd: How do you define your own function on this body, bearing in mind that you are to some extent being held to account by them and yet you are the Chairman of it?

Mr King: I think the accountability is ultimately with Court, which is, of course, chaired by a non-executive director, not by me, but the way in which Court holds us accountable is because of the information and views provided to it from the non-executive members of the Financial Stability Committee. If this committee is to engage in a serious debate about the structural reforms and issues that the Bank is engaging in and the individual cases that we are involved in it really is going to have a serious input into those decisions. The Governor will have to chair it; otherwise it will not be a committee which really is getting to grips with the policy issues which the Bank is facing.

Q134 Mr Fallon: I do not understand this. You said at the very beginning to Mr Todd that the executives of the Bank led by yourself would be accountable to this committee but you will chair it. How can you be accountable to a committee that you will chair?

Mr King: I said that the committee has both accountability and executive functions. It has both of those. The accountability is the reporting back to Court by the non-executive members of the Financial Stability Committee.

Q135 Mr Todd: This is a beast of a very different kind from the Court and will require rather different membership. You will be aware of the potential conflicts of interest that will arise from the selection of some members.

Mr King: Indeed.

Q136 Mr Todd: You may have heard my line of questioning which was perhaps looking at an international dimension to membership, which I note is already on your Financial Stability Board. You have a Swedish banker, I think.

Mr King: Yes, a former member of the Riksbank.

Q137 Mr Todd: I will say straightaway I am presuming that you will not have a role in the appointment of these members because that would be presumably inappropriate, bearing in mind the discussion we have had.

Mr King: Yes. The non-executive members of the Financial Stability Committee will be drawn from the members of Court. Members of Court are appointed by the Government, or the Crown on the advice of the Government, and Court itself will then choose the subset of members that will serve on the Financial Stability Committee.

Q138 Mr Fallon: Can I give you one more opportunity to explain, Governor, how you yourself can be accountable to a committee that you will be chairing?

Mr King: Because the accountability is to Court. It is through the Financial Stability Committee to Court. If you want this committee to get seriously involved in individual decisions and judgments where it is making a major input into those decisions and it is not simply holding the executive to account; it is actually making an input into those decisions, then it is not just a committee which is involved in accountability.

Q139 Mr Fallon: All right. Let me take you back to something you said to the Chairman on the Special Resolution Regime. You said the Bank would make a recommendation if necessary that a bank be put into the Special Resolution Regime, and I thought you had won this battle with the Treasury but the document says, "The Government proposes that initiation of the regime would be subject to an assessment by the FSA". Have you won this battle or not?

Mr King: I do not think it is a battle. It is true that I would have preferred an outcome in which either the FSA or the Bank of England could have initiated the trigger. We will not have the right to initiate the trigger. We will have a right to make a written recommendation to FSA that they initiate the trigger. That is clearly not the same thing, but in due course I would expect that if there were problems with this you yourself would want to comment on whether or not FSA did or did not respond in a sensible way to the advice that we gave, so I think we have a major say in giving advice as to whether the trigger will be pulled, but it is true that we will not be pulling the trigger.

Q140 Mr Fallon: The Government go on to say, "The Bank of England would be able to make recommendations to the FSA regarding this assessment", about the trigger.

Mr King: Yes.

Q141 Mr Fallon: But you will not be able to make a recommendation independently of the assessment by the FSA, will you?

Mr King: Yes. The FSA have said that all the information and data concerning the bank in question would be made available not only to ourselves but also to the Treasury, so the tripartite authorities which share all that information. That would enable us to make a judgment ourselves as to whether we thought the trigger should be pulled, and if we thought it should we would make that recommendation.

Q142 Mr Fallon: So you could identify a bank that the FSA was not yet ready to identify and say in your view as a recommendation that you thought that was ready for the regime?

Mr King: Yes.

Q143 Chairman: Governor, you mentioned our role. How will we know what advice you have given to the FSA? This will surely be in private. It would only be a post mortem.

Mr King: It would be a post mortem but I do think that the ex post accountability that you engage in is extremely powerful.

Q144 Chairman: In other words, after another possible shambles people will come along here and we will find out what advice you gave to the FSA?

Mr King: That is all the power which I have.

Q145 Chairman: The issue, Governor, on Northern Rock was an issue of clarity of leadership and precision and, as I have mentioned before, every participant came along and said they did their job.

Mr King: As I have said to you, I would have preferred a regime in which we had the power to pull the trigger. The Treasury have decided that is not the power that we will be given.

Q146 Chairman: Okay, so this is the first fuzzy aspect of this?

Mr King: I do not think it is fuzzy. I think it is clear. It is not the one I would have chosen but it is clear.

Q147 Chairman: Okay, it is clear, but it is not in your favour and will maybe not be in the best interests overall.

Mr King: That is for you to judge. We have made our view clear. We lost the argument on that, and that is fair enough. We are not going to keep fighting about that.

Q148 Mr Fallon: Sure, but there would be two institutions potentially still making recommendations -----

Mr King: Yes.

Q149 Mr Fallon: ----- and at the same time a different point, saying a bank could be about to fail?

Mr King: Under the regime which we proposed there would have been two bodies that could have taken that decision. You seem to me to have no problems with that.

Chairman: Okay, clarity, oh, clarity.

Q150 Mr Brady: Just to follow that up, if you write this letter, this recommendation, and the FSA does not agree with you, at what point might that become public?

Mr King: That would depend on how the circumstances panned out. If nothing happened to the bank and it never entered a Special Resolution Regime maybe no-one would discover it, but I imagine that some years down the road eventually you would ask the question, "How many recommendations did the Bank make which were not acted upon?", and then you would find out.

Q151 Mr Brady: I will try to remember to ask the question.

Mr King: I hope you will be around long enough to find out.

Q152 Mr Brady: If the Bank of England has responsibility for the Special Resolution Regime and for the choice of tools to be used within it, do you envisage that would mean having an in-house expertise and capability to run it or would you rely on co-opted people to do that?

Mr King: No, there will have to be some in-house team running the Special Resolution Regime, clearly. I think it is fair to say that all such bodies around the world, whether it is the FDIC in the United States or the equivalent in Canada or elsewhere, operate with a certain minimum level of staff on a permanent basis and then bring in staff quickly when circumstances demand that a bank be put into a Special Resolution Regime. One of the things that we will be doing in the autumn is working out the details of how we are going to manage that organisation, both the permanent staffing of it, which will require rather different kinds of people than we have in the Bank at present, and also the basis on which we know that we will be able to attract people very quickly, often at only a few hours' notice, in order to beef up the staff when dealing with a particular bank to be resolved. That is exactly the way the FDIC operates in the States and we will certainly want as far as we can to take advantage of the expertise and knowledge which those bodies have and have exercised over many years. We have had very useful contacts with them already.

Q153 Mr Brady: Do you have a sense at this point of what kind of additional resource you would need for that minimum capability or is it too soon to say?

Mr King: I think it is too soon. It would just be pulling something out of the air. The Americans have a permanent staff of 200. That is because they have many more banks. They have had five banks fail this year. The big challenge to us in this regime is that we would expect to have many fewer banks in the regime than, say, the Americans, but if it were a bank in the regime it could well be much bigger than the average bank dealt with by the Americans. That I think is the big challenge because they have never had to resolve in terms, say, of paying out depositors quickly, anywhere near the number of accounts that even, say, Northern Rock had, so there is a big logistical challenge in designing a regime which will not be used frequently, we hope, but when it is required has to operate very effectively and on a much larger scale than almost anyone else in the world has done so far.

Q154 Mr Brady: There have already been some questions about the structure and how it will provide accountability, a slightly different aspect of that. How can the Financial Stability Committee provide accountability for the regime when its members will have been parties to the decision-making process in implementing that regime?

Mr King: That is exactly my point, which was that accountability for those decisions, I think, rests directly with you, that the Bank will be directly accountable to you. It will be accountable to Court but in the end the use of the Bank's balance sheet Court itself will want to have a say on, as it did on Northern Rock, and if Court decided to use the Bank's balance sheet then how is Court accountable? It is to you, it is to the Chancellor; it is direct accountability of that kind. If you want the non-executives to be involved in some way in giving advice and being involved in the decisions then you have to accept that they cannot entirely operate a completely hands-off accountability role.

Q155 Ms Keeble: What is your view of the proposals for the new depositor protection arrangements?

Mr King: I think the main proposal, which is that we would move to 100% deposit insurance up to some limit where one of the candidates for that limit is Ł50,000, is all very sensible. It is what I recommended to you right back in September only a few days after the run on Northern Rock. I think you cannot hope to avoid a run unless you have a regime of that kind in place, because once you have a regime of that kind in place there is a problem because the banks themselves may feel that, to the extent that they can fund operations by raising retail deposits, the risk of those retail deposits now falls entirely on other banks or on the taxpayer ultimately, and that is why we are in favour of risk-based premia for this insurance scheme. We think that the banks, when providing the funds to finance the deposit insurance scheme, should pay a contribution which reflects the riskiness of the bank. In order to do that some element of pre-funding (it does not necessarily have to be enormous but some element of pre-funding) is desirable. That will be consulted on in the autumn and that is for a future consultation. I would hope that that issue will still be on the table. I think it is important. I do not think it is a good idea to offer 100% insurance up to, say, Ł50,000 without any element of a risk-based premium at all, and to do that you need some element of pre-funding.

Q156 Ms Keeble: I wanted to ask about the pre-funding. In particular do you think that the new arrangements, which are obviously going to be important if a bank does fail in that people will get their money and be able to manage their finances and so on, would also help prevent a further run? Do you think they would provide the assurances that people need to prevent the kinds of things we saw with Northern Rock?

Mr King: I think they will certainly make a very big difference and it will certainly help. In itself it is not enough. There was a very interesting episode that has just taken place in the United States where they have this deposit insurance but when Indy Mac failed they had a run. In fact, they had queues of depositors outside all 33 branches. The reason was not that they did not have the right scheme. The reason was that they had perhaps not communicated enough to all the depositors the nature of that scheme. The lesson from this is very interesting. If you think back to the experience we had in the autumn, FDIC Chairman, Sheila Bair, said, and note this is about America last week, "Nobody anticipated the kind of media that was going to get played and, frankly, in an inflammatory way with some of the networks. This has been pretty non-stop since Friday. There were lines outside the branches for four days. Officials blame the problems on extensive television coverage which heightened the anxiety of the consumers that depositors would not have access to their money." Communication is at least as important as putting this scheme in place.

Q157 Ms Keeble: Is the idea that people can get more money out faster with more assurances not more likely to make them go and get more money out?

Mr King: Sorry?

Q158 Ms Keeble: If you have a scheme which is guaranteed to pay people out more money more quickly -----

Mr King: Then why would you waste your time going to stand outside a bank?

Q159 Ms Keeble: Alternatively you might hurry down more quickly. As you say, it is a question of how this -----

Mr King: If it is paid out by the deposit insurance scheme rather than the managers of the bank, that is the important thing.

Q160 Ms Keeble: Can I ask you about the pre-funding? As I understood it there are two options. One is that there could be a loan taken out against the public sector and the other is with the pre-funding and those are two quite different schemes. I had understood that the balance of opinion was in favour of the first rather than the second but you are arguing for pre-funding. I wonder if you could comment on that and also say if there has been any scoping out of how much money would be needed, because that is obviously fairly critical for the success of any scheme.

Mr King: Yes. On the first, the Bank's view still remains that we think an element of pre-funding would be a desirable part of this scheme. I think it is fair to say we have not convinced all other participants in this debate yet. I think it is rather short-sighted myself to use the argument that the banks should not be asked to put up money now. No-one is suggesting that this year is the time when you would ask banks to put up money, but if you wait until there is a problem that is a pretty bad time to ask the banking system to put up a large amount of money.

Q161 Ms Keeble: I understand that but the case that you were talking about in the States was a bank with 33 branches.

Mr King: Indy Mac, yes.

Q162 Ms Keeble: We are probably looking at something rather different in the UK.

Mr King: That is why I think we have used the phrase very carefully, "an element of pre-funding". We are not necessarily suggesting that you will be able to rely on pre-funding to pay for everything.

Q163 Ms Keeble: What does "element" mean? Has there been any discussion on the amount?

Mr King: There is obviously a choice. You can choose how much you would raise by pre-funding and how much by post-funding. There is no obvious division which is optimal. That is a debate I would like to see. I think some element of pre-funding is necessary in order to enable you to set the premia on the basis of the risk of the bank. That is the important principle.

Q164 Ms Keeble: If you say "an element of pre-funding" how much would it be in percentage terms and what would it be expected to raise because that must be critical in terms of the success of the scheme? Is it X billion, Y billion? I do not know. What percentage and what does that then mean for the premia?

Mr King: There are lots of choices. You can have a small premium of only a few basis points on the level of deposits of a bank or many more basis points. You can choose how much. The size of the fund is something that you could choose, to have a bigger or a smaller fund.

Q165 Ms Keeble: What would you recommend?

Mr King: I do not think I would want to recommend a particular number at this stage but something that would amount to a non-negligible contribution, so that over, say, ten years you would have built up a fund of many billions, so certainly into the billions over ten years.

Chairman: Non-negligible billions, okay.

Q166 Nick Ainger: I do not know if you, Governor, are going to answer this question or one of your colleagues because it is about the detail of how the depositor protection scheme will work for banks that are based in the EEA and have branches here which are deposit taking. We have had a note from the FSA following the evidence session we had with them which explains in some detail how it works. Can you confirm that under the proposed arrangements, if there is a bank which is foreign owned, based in the EEA, that has branches here and gets into difficulties, the first call that a depositor would make would be on the home depositor guarantee scheme, not on the FSCS? Is that correct?

Mr King: The only people who can answer this question are the FSCS themselves; we cannot. It is nothing to do with the Bank of England, but as we understand their position a depositor would have a call on two funds. The first amount would be up to the level of deposit protection offered by the home European state in question, which varies according to the European state. The difference between that and the figure which is the limit for FSCS would be contributed by the FSCS. There would be two contributions if the amount in the deposit account was up to, say, the FSCS limit, and you would have to make two claims for these two different amounts.

Q167 Nick Ainger: But is that not the problem, that we want a scheme which is designed to prevent people creating a run on a bank, in other words, an easy, quick way of an assurance that you can get your money out quickly? If we have a scheme where we have a significant number of branches of foreign owned banks where you have to go and claim in another country for that depositor protection, is that not going to lead to runs on banks because people will believe it is going to be incredibly difficult and complex, whether it is or not, and be time-consuming too if they have to go to the country of origin depositor protection scheme rather than call in straight on the UK one?

Mr King: Certainly, any depositor who decides to put their money into the branch of an overseas bank that is not regulated by the FSA has to ask questions about whether or not it is safe to do so. This is a question really for FSA and FSCS about whether or not UK retail depositors should or should not have access -----

Q168 Nick Ainger: But surely you have a view?

Mr King: No, I do not have a view. It is not my responsibility and I do not like going round telling FSA or the FSCS what regulation they should have. It is true that if foreign banks in the UK have branches in the UK and people can put deposits in those branches, then, unless they are covered by the FSCS, which would be the case if they came from outside the EEA, then you have to apply to two deposit authorities. That is something which is a decision of the European authorities. It is not to do with the Bank of England. It is not even to do with the UK authorities. It is a European agreement. You may want to raise that yourself with the relevant ministers to see whether this is a suitable outcome.

Q169 John Thurso: Governor, in our report The run on the Rock we made it clear that we could not accept the evidence that had been given that the tripartite system operated well. We disagreed fundamentally with that. In your speech to the British Bankers' Association in June you said the Memorandum of Understanding regarding the tripartite arrangements was not so much faulty as incomplete. What was missing and what has been done to plug the gap?

Mr King: I think what was missing were two or three things. One is the set of issues we have been debating this morning, the Special Resolution Regime for banks. The reason why Northern Rock dragged on and on was the absence of any Special Resolution Regime. That bank would have been dealt with immediately under a Special Resolution Regime. It could not be because nationalisation was the only alternative. The second is deposit insurance where there was an incentive to have a run in the absence of a 100% deposit insurance, and, thirdly, it is fair to say that the tripartite arrangements were seen as a communications framework in which people would communicate their own responsibilities to each other. With regard to the lender of last resort facility, clearly mistakes were made, as you pointed out in your report, about the failure to grant the guarantee early enough. That was clearly a failure; it should have been granted earlier, but in terms of communication the things we had to communicate with each other we did. The framework was incomplete in the sense that we were not discussing detailed information about individual banks enough between the FSA and the Bank of England, and since the late autumn that has changed really quite dramatically. There are now regular tripartite meetings at principals' level. There was none before. There are regular discussions between FSA, the Bank and Treasury about individual institutions and contingency planning. All of those things, understandably, in the context of the financial crisis, we have gone into action on and I think it has worked pretty well since then. I think all three parties would say that they feel they have worked together pretty well.

Q170 John Thurso: Would you say that the core function of the tripartite arrangement therefore is to be a communication vehicle between the three institutions?

Mr King: Yes, I think it is. Each of them has very clear specific responsibilities for which this Committee holds us accountable. We cannot devolve those responsibilities onto others.

Q171 John Thurso: Is there any moment at which the tripartite group should become a decision-making body? Is it capable of that? Should it be there?

Mr King: I think it certainly would in the context of the question of resolving a bank where the right solution of resolution involved the use of public money. I think it would be almost impossible to avoid a situation where, if FSA wanted to say to the other members of the tripartite authorities, "In our view this bank is close to failing. We ought to start to prepare for the contingency of going into the Special Resolution Regime", the Bank of England would say, "We have looked at the various options here. Our preferred option for this bank does involve the use of public money for a period and that cannot be done without the Treasury agreeing that". The Chancellor has to have the opportunity to reflect on that and decide whether or not it is an appropriate use of public money. I think in that situation all three bodies have to work very closely together, yes.

Q172 John Thurso: Because the only way in which you can join up the evidence that we had, which was three separate groups of people saying they had all done their job, and the overall view, which was that the job did not get done, was to say that there was something missing in that communication between them or in the decision-making process.

Mr King: No, there is a third possibility, which is that the three bodies between them did not have sufficient powers to deal with the situation and that is my point from the very beginning here. The fact that no one of those three parties had the ability to put Northern Rock into a Special Resolution Regime and the fact that we did not have 100% deposit insurance were major contributors to the problems that we faced.

Q173 John Thurso: So your view is that with these additional tools, if one had an unfortunate circumstance like Northern Rock again, the mistakes or whatever would not occur again?

Mr King: We certainly would handle it differently. I cannot promise you we would not make mistakes, everyone can make mistakes, but certainly these powers would make an enormous difference.

Q174 John Thurso: On another matter entirely, which I asked you about a couple of times ago, Scottish bank notes, we have had a happy resolution to that in that we are going to be able to go on producing our Scottish bank notes. Were you party to the ultimate compromise and were you content with it? Will it do the job?

Mr King: We were certainly deeply involved in all the discussions. The question of how the profits of note issue are divided between taxpayers and note issuing banks is a matter for the Treasury, not for us, so that is a question you must put to the Chancellor, but in terms of the details of how we all managed that agreement, we were closely involved and Andrew Bailey is the man who was responsible and involved in that.

Mr Bailey: The first part of it was as the Governor said. The second part is how you allocate the income received by the note issuing banks from issuing those notes, but the first part of it is all to do with saying there is a set of risk-free assets that are there to back the note issue and are there to protect the holders of notes in the event of a failure of one of the note issuing banks. In the current regime there is, in fact, no ring-fencing so that those assets are, in the event of insolvency, available to the note holders. They would just be in the general pool of assets, and the new regime will achieve that, so yes, we are happy that we are going to get that and that is what we think is appropriate.

Q175 Chairman: Clydesdale Bank were one of the banks that I think had quite major concerns on it and they did speak to me a couple of weeks ago and they seemed very happy with that.

Mr Bailey: That is my sense too.

Q176 Mr Dunne: Can I take you back to the questions that John Thurso was asking in relation to the role of the Treasury in the new tripartite arrangements? It is clearly appropriate that the Treasury and the Chancellor are involved in the design of the regime. We have had evidence from the non-executive directors of the Court that they think it is appropriate not to be involved in the implementation of the tripartite arrangements going forward. How is that possible if ultimately it is the Chancellor's decision whether to commit public money to a situation?

Mr King: It would depend on which tool was used in the Special Resolution Regime. A number of the tools would not apply the use of public money. The way I see it operating is that the Bank would decide what tools were the appropriate tools to use. If they did not involve the use of public money the Bank would simply implement it. If they did involve the use of public money the Bank would have to go to the Treasury and make the case, and the Treasury would certainly be entitled to say, "No, we do not think this is an appropriate use", and the Bank would then have to move down the list of tools until it found one that either did not involve the use of public money or which the Treasury were content to adopt. I think that is a reasonable position. I do not think the Bank can possibly assume the right to determine the use of public money for these things. It has to be decided by the Chancellor.

Q177 Mr Dunne: I agree that that is where the decision needs to lie, but, given that we are talking about exceptional cases and probably large cases here where large amounts of public money may be at stake and therefore the decision for the Chancellor may be a very difficult one, surely it is right that the Treasury and the Chancellor are involved at the very earliest stage in determining whether this is an option or not, because it might influence whether or not the FSA exercises the trigger and you then get involved and go through that decision tree you have just described?

Mr King: That is one of the things which I am sure would be discussed at length in the tripartite arrangements, but the point is that the decision on what tool would be used would in the end be the responsibility of the Bank of England. Therefore, you can hold us accountable for it and we would not want to go ahead with a tool that we felt was inappropriate.

Q178 Mr Dunne: Will that not potentially set up the same disagreement between the Governor of the day and the Chancellor of the day if the Chancellor is determined not to make public money available?

Mr King: No. We will find other ways round the problem if there is no public money available. That is the job of the resolution authority. I do not think we can say to the Chancellor, "You have to give us this money to make it work". We can say, "Our advice would be that public funds be used in this situation", (or not, as the case may be), but he must be entitled to say no, and if he says no we have to work round it. That seems to me to be perfectly reasonable.

Q179 Jim Cousins: Governor, it is clear under the existing legislation that the responsibility for testing whether a bank has adequate financial resources lies with the FSA as the regulator, but is it not also clear from your own presentation this morning that when this new regime is put in place the Financial Stability Committee will be working alongside that, overshadowing that regulatory responsibility of testing adequate resources? Is there not a rich potential for muddle here?

Mr King: I think not but let me explain how I think the regime would work. I think we feel it is helpful to think in terms of banks in a green zone, amber zone and red zone, where red zone is the bank that has already gone into the Special Resolution Regime, green is a bank that is under the normal supervisory regime of the FSA and there are no obvious concerns, and amber is the regime where there is a bank about which there is a concern. I think it is in the amber regime that FSA would want to (and it has said it would) share all the information that it had about the bank with the Bank of England, and that the Bank of England would want to acquire information about that bank in case that bank ultimately got into the Special Resolution Regime. One of the problems we had with Northern Rock was that, having had a regime with a very clear separation of responsibilities, we actually knew almost nothing about Northern Rock and we knew nothing at all about the collateral that it had, which made it more difficult than would otherwise have been the case when it came to us lending the lender of last resort facility against that collateral. We feel that in the run-up to that sort of operation we need to be involved earlier in order to acquire information that would be relevant to us under our own responsibilities, not to second-guess the regulatory judgment of FSA but to prepare ourselves for responsibilities that we might be called upon to meet.

Q180 Jim Cousins: Governor, we have had some evidence from the FSA which casts doubt upon a clear distinction between green, amber and red. When we asked the FSA what they meant by heightened supervision they made it clear they could mean any one of a whole range of different things of varying significance and importance. In a situation where you are operating the clear sense of green, amber, red and the FSA are not, is there not a rich possibility of muddle and confusion?

Mr King: No, I do not think so, because what FSA said when they gave evidence to you was that the distinction between green and amber was not one that was capable of being announced to the world at large according to a certain precise criterion, and it is very important that the world at large not know the distinction between green and amber because otherwise it would be very hard to intensify supervision of a bank without telling the world that the bank was in trouble. It is very important that FSA can change the degree of supervision, whether it is heightened or intensive, of an institution internally in order to deal with cases that it is worried about without having to alert the world at large that it is doing that. That is what it meant by that, but it would certainly talk to us about whether or not it was more or less concerned with an institution, and it has done that all along, so I do not think we would have any difficulty in discussing with FSA whether we felt the bank was in a situation that we ought to take more interest in.

Q181 Jim Cousins: We are now getting a picture of quite a complex process and you yourself have referred this morning and on other occasions to the importance of communication, and you have made it clear that you do not think this amber state, if we are going to use your terminology, should be communicated, but has there ever been any formal inquiry as to how the leak which caused the run on Northern Rock ever took place? Has there been any formal inquiry into that at any stage by anyone?

Mr King: As far as I know no institution has instigated a formal inquiry, no.

Q182 Jim Cousins: Governor, do you not accept that there is a certain moral hazard, if I can use that term, in not carrying out such an inquiry into how that happened because in the absence of such an inquiry how do we know that all these discussions that will be going on in the amber phase between a whole variety of different people in your two organisations, involving the Financial Stability Committee, will not be leaked?

Mr King: All I can say is that if you would like to hold your own inquiry into what happened you would be very welcome to. I do not think any leak inquiry has ever produced a very productive result, and I think it is pretty clear where leaks tend to come from.

Q183 Jim Cousins: But, Governor, this Committee is not the appropriate agency to do that, as you know perfectly well, and you must also appreciate, Governor, because you yourself used the term "moral hazard" on a regular basis, quite properly, that if significant leaks occur and no inquiry is made into those there is an element of moral hazard that results.

Mr King: I am absolutely convinced that no leak emanated from the Bank of England. I have no idea where the leak came from. Others can ask themselves that question if they want to.

Q184 Chairman: Governor, I thought you said it was pretty clear, you thought, where the leak came from. Did I hear you wrong?

Mr King: No, I did not say that.

Q185 Chairman: What did you say was pretty clear then?

Mr King: I said leaks in general are those things which you are more expert in than those of us in public bodies. I think you are much more expert in where these things originate from and how they come out.

Q186 Jim Cousins: I am sorry, Governor, this is a serious issue.

Mr King: It is a serious issue.

Q187 Jim Cousins: It is too important for that kind of by-play. You know perfectly well the credibility of this system will depend on an absence of leaks.

Mr King: I have given you an assurance that no leak came from the Bank of England in any respect of any issue in the last year that has come up. There are a number of issues where leaks have occurred, where things have reached broadcasting authorities. None of it came from the Bank of England. I cannot carry out any investigation into a leak from any other authorities.

Q188 Jim Cousins: But, Governor, what are we on this Committee and in Parliament when we consider this legislation to make of a system where there are inquiries into bottom feeders' leaks, young men at computer terminals, but there are no inquiries into top people's leaks?

Mr King: What top people's leaks are you thinking of?

Q189 Jim Cousins: What occurred last September.

Mr King: I suggest you ask the other authorities involved what they have done about it.

Jim Cousins: Thank you.

Q190 Chairman: Going back to the point about depositor protection earlier on, what we have found is that the banks are very resistant to the rapid payout from depositor protection because that will have a high cost on them upgrading their systems. Do you think that such a cost is worthwhile in order to reduce the possibility of another run on a bank?

Mr King: I do, and I think it is not something that we should insist be done immediately. Banks should be given a period of time over which to do it. The FDIC in the United States gave banks 18 months in order to ensure that their information on depositors was in a conforming standard that could then be handed to the FDIC in the event that the FDIC took control of a bank. There are many things that we could do that would make the management of either payout of depositors or transfer of a deposit book to another bank much faster and more efficient. I think that ought to be part of the regime of protecting depositors and I think the banks should be given time, several years, to get to that point but it is important that we embark on it.

Q191 Chairman: As you know, in our report we were for the principle of prepayment but we have left it to others to work out, but the principle itself is important and work should begin on that because if the principle is not there then institutions could take excessive risks in the future.

Mr King: I agree, and I would be in favour of that work being done and I think it can be designed in a way that over a period of time does not impose excessive costs on banking.

Q192 Chairman: The Bank of England is to be granted immunity from damages in respect of its central bank functions. Why has that not been thought necessary before and why does it matter now?

Mr King: It was thought necessary up until 1997 and I think it was some oversight that it was not extended. I think the assumption was that all of our regulatory responsibilities would be handed to FSA and therefore we did not need an immunity. Now, of course, we will have regulatory responsibilities under the Special Resolution Regime, and indeed on payments systems, and I think most people have commented in the consultation responses that they feel it would be appropriate for the immunity to be given to the Bank.

Q193 Chairman: Will that immunity have retrospective effect as well, do you think?

Mr King: I have no idea. I rather doubt it, but I do not know.

Q194 John Thurso: I have just one question on the general concept of financial stability. We all know we want it and we all know when we have not got it, and the causes of financial instability during the last year are numerous and we have discussed them and they are greed and hubris and inexperience and all sorts of things, but when your new committee sits what tools do you have to do anything about any of those things that are going to have any effect?